Kunal Chopra

Jan 29, 2026

Federal procurement officers are rejecting bids at unprecedented rates. The primary cause is not pricing or capability, but rather fundamental Buy American compliance breakdown points where domestic mandates meet global supply chain reality. Manufacturers who have operated successfully for decades now face a stark choice between maintaining international supplier relationships and qualifying for domestic preference contracts worth billions annually. The 2026 threshold increases under the Buy America Act compliance framework demand 75% domestic content calculations reaching new benchmarks. This shift exposes structural weaknesses in how global enterprises track, document, and verify component origins. Understanding precisely where Buy American compliance breakdown occurs enables strategic intervention before federal contract violations result in costly penalties.

Table of Contents

The Collision Between Domestic Mandates and Global Sourcing

Why Traditional Supply Chains Struggle with Buy American Requirements

Critical Compliance Failure Points in Multi-Tier Networks

Documentation Gaps That Trigger Federal Contract Violations

Building Compliance-Ready Global Supply Chain Infrastructure

Strategic Approaches to Balancing Domestic and International Sourcing

The Collision Between Domestic Mandates and Global Sourcing

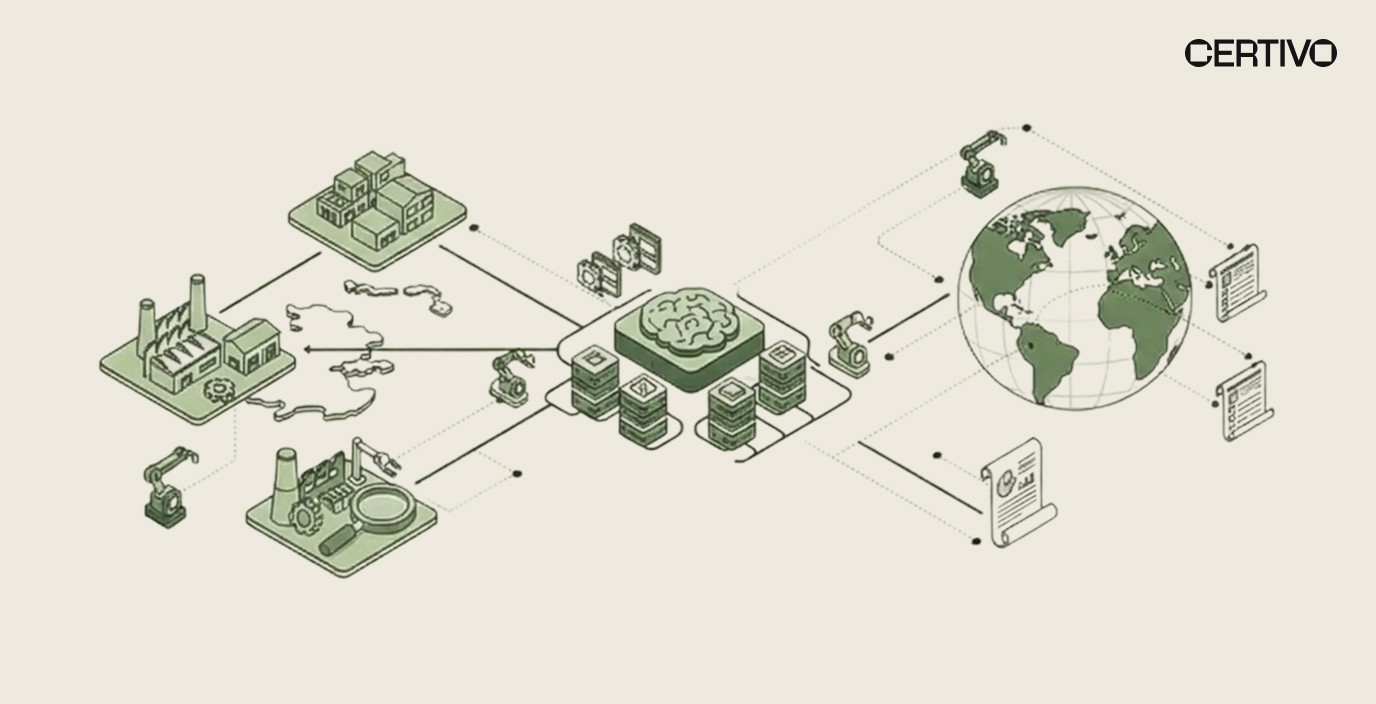

Modern manufacturing operates on interconnected global networks optimized for cost efficiency, specialized capability, and just-in-time delivery. These networks evolved without consideration for country-of-origin documentation at the component level. When Buy American requirements intersect with established supply chains, fundamental incompatibilities emerge that create systemic Buy American compliance breakdown across every tier.

The core tension exists between procurement efficiency and global supply chain compliance verification. Global supply chains prioritize speed, cost reduction, and supplier redundancy. Buy American requirements demand precise origin documentation, domestic content calculations, and verifiable transformation tracking. These objectives operate in direct opposition without intentional compliance infrastructure bridging the gap.

Adding complexity, manufacturers must navigate distinct regulatory frameworks that often create confusion. Understanding the key differences between Buy American, Buy America, and BABA proves essential for determining which domestic sourcing requirements apply to specific contracts. Each framework carries unique thresholds and enforcement mechanisms that affect global supply chain compliance strategies differently.

Manufacturers who previously viewed domestic sourcing requirements as checkbox exercises now face rigorous enforcement. Federal agencies have increased audit frequency, and federal contract violations now trigger contract terminations, debarment proceedings, and reputational damage. The Buy American compliance breakdown points that once represented minor administrative inconveniences now carry severe consequences affecting future procurement opportunities.

Why Traditional Supply Chains Struggle with Buy American Requirements

Traditional supply chain management systems were designed for logistics optimization, not regulatory compliance verification. Enterprise resource planning platforms track inventory movement, cost allocation, and delivery timing. They rarely capture the granular origin data required to perform accurate domestic content calculations. This architectural limitation creates systemic Buy American compliance breakdown that technology upgrades alone cannot address.

Multi-tier supplier compliance presents particular challenges in achieving global supply chain compliance. Primary suppliers may maintain adequate documentation, but their upstream sources often lack compliance awareness entirely. A domestic assembler purchasing from a domestic distributor may unknowingly incorporate foreign-origin components that disqualify the final product. Without visibility beyond immediate supplier relationships, manufacturers cannot certify compliance with confidence or meet Buy American requirements consistently.

The complexity multiplies when considering component transformation and domestic content calculations. Raw materials sourced internationally may undergo substantial transformation domestically, potentially qualifying as domestic content under certain interpretations. However, proving sufficient transformation requires documentation most supply chains never anticipated collecting. Supplier compliance programs must evolve to address these multi-tier supplier compliance verification requirements systematically.

Cost allocation methodologies create additional supply chain documentation gaps. Buy American requirements specify that domestic content calculations determine what percentage of a product's cost derives from domestic sources. Traditional accounting systems allocate costs for financial reporting purposes, not regulatory compliance. The methodologies rarely align, forcing compliance teams to reconstruct cost data manually and risking federal contract violations through inaccurate reporting.

Critical Compliance Failure Points in Multi-Tier Networks

Buy American compliance breakdown occurs at specific, predictable points within global supply chain architectures. Identifying these failure points enables targeted intervention rather than wholesale supply chain restructuring. The most critical breakdown occurs at supplier documentation handoffs where origin certificates, transformation records, and cost allocation data transfer between organizations, creating supply chain documentation gaps.

Primary Failure Points:

Supplier self-certification without verification mechanisms

Incomplete country-of-origin documentation creating supply chain documentation gaps

Domestic content calculations inconsistencies between supplier tiers

Transformation documentation gaps for processed materials

Conflicting origin claims leading to federal contract violations

The supplier self-certification model that underpins most programs assumes honesty without verification. Suppliers attest to domestic origin, manufacturers compile these attestations, and federal contracting officers accept the documentation. When auditors examine actual supply chains, discrepancies emerge that trigger federal contract violations. Risk assessment frameworks must incorporate verification protocols that validate multi-tier supplier compliance systematically.

Documentation inconsistency across supply chain tiers creates audit vulnerabilities even when all parties act in good faith. One supplier may classify a component as domestic based on final assembly location. Another may use raw material origin as the determining factor. Without standardized classification criteria across the supply network, domestic content calculations become unreliable, and Buy American compliance breakdown becomes inevitable.

Global supply chain compliance requires addressing these multi-tier supplier compliance challenges proactively. Organizations that wait for audit findings discover that supply chain documentation gaps have already created federal contract violations with significant financial and reputational consequences.

Documentation Gaps That Trigger Federal Contract Violations

Federal auditors follow documentation trails. When those trails contain supply chain documentation gaps, inconsistencies, or unsupported assertions, federal contract violations result regardless of actual compliance status. The documentation burden for meeting Buy American requirements exceeds what most supply chains generate organically, requiring intentional collection systems that capture origin data at each transformation point.

Common documentation deficiencies include missing certificates of origin for imported materials, incomplete cost breakdowns affecting domestic content calculations, and absent transformation records for processed goods. Each deficiency represents a potential audit finding that can escalate from administrative correction to contract termination. Compliance management platforms address supply chain documentation gaps through structured data collection workflows.

The Federal Acquisition Regulation establishes specific documentation requirements that many manufacturers underestimate. Beyond simple origin certificates, contractors must maintain records demonstrating domestic content calculations, transformation processes, and supply chain verification procedures. The Code of Federal Regulations Title 48 details these Buy American requirements, but practical implementation guidance remains limited.

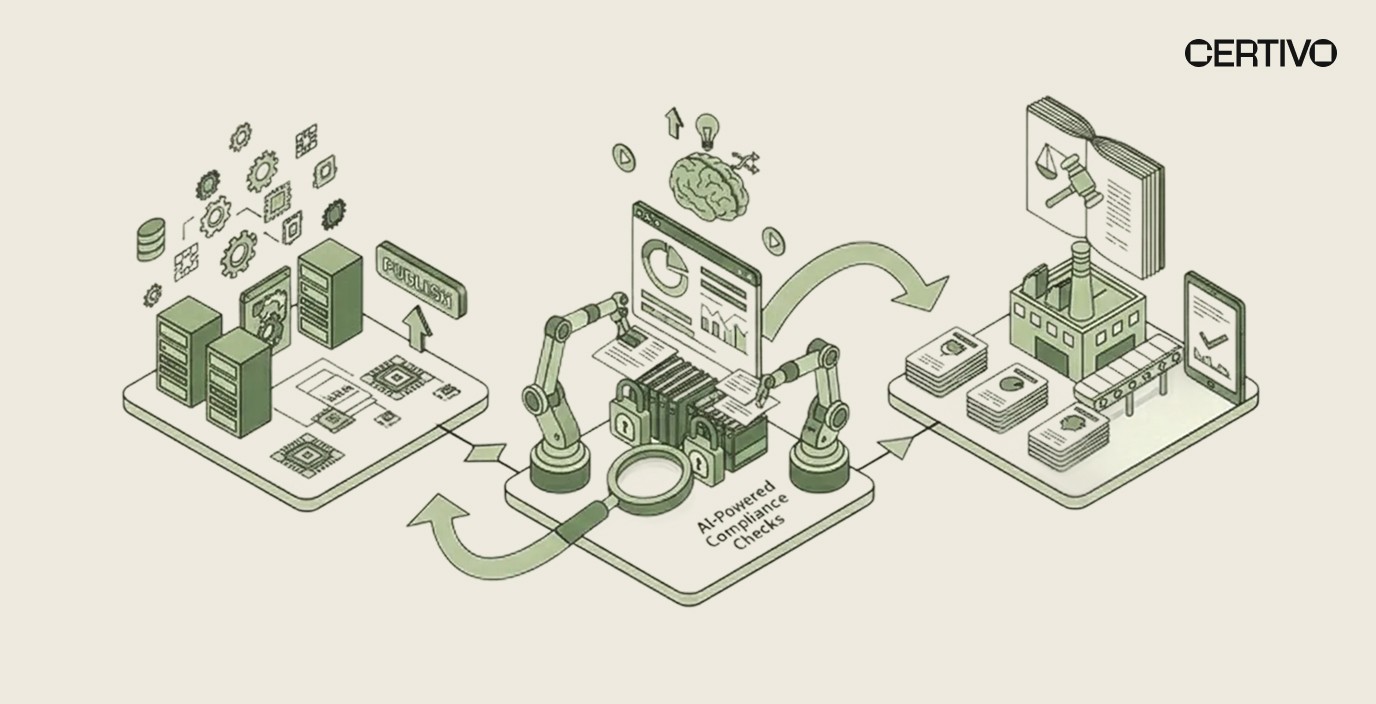

Certivo's approach to eliminating supply chain documentation gaps leverages AI-powered data collection and CORA, an intelligent assistant designed for supplier follow-ups and data completion. Rather than relying on manual document chasing, the platform automates the collection process while maintaining human-in-the-loop verification by compliance experts. This combination addresses Buy American compliance breakdown at scale without sacrificing accuracy.

Time-stamping and version control failures compound problems leading to federal contract violations. Federal auditors expect consistent, contemporaneous records demonstrating global supply chain compliance at the time of contract performance. Retroactively assembled documentation packages raise credibility concerns even when accurate. Real-time compliance tracking prevents these evidentiary challenges and supports accurate domestic content calculations.

Building Compliance-Ready Global Supply Chain Infrastructure

Addressing Buy American compliance breakdown requires infrastructure investment, not merely procedural changes. Supply chains optimized for efficiency must incorporate global supply chain compliance verification capabilities without sacrificing operational performance. This balance demands technology platforms capable of collecting, validating, and calculating compliance data automatically while meeting all domestic sourcing requirements.

Infrastructure Requirements:

Automated origin data collection supporting multi-tier supplier compliance

Real-time domestic content calculations across all product lines

Supplier verification preventing supply chain documentation gaps

Audit-ready documentation repositories preventing federal contract violations

Exception alerting for Buy American requirements threshold violations

The AI-driven compliance solutions available today fundamentally change what is achievable for global supply chain compliance. Rather than sampling supplier documentation periodically, manufacturers can implement continuous compliance monitoring that identifies Buy American compliance breakdown before it affects contract eligibility. Market readiness scoring provides visibility into which products meet domestic sourcing requirements.

Supplier onboarding represents a critical infrastructure element for multi-tier supplier compliance. New suppliers must understand Buy American requirements and commit to providing necessary documentation before purchase orders flow. Compliance criteria should appear in supplier qualification processes, contract terms, and ongoing performance evaluations. Supplier management systems must incorporate these compliance dimensions alongside traditional performance metrics.

Integration between compliance platforms and existing enterprise systems prevents duplicate data entry while ensuring domestic content calculations reflect actual supply chain activity. When procurement, logistics, and compliance systems operate independently, data discrepancies emerge that create supply chain documentation gaps and undermine audit defensibility.

Strategic Approaches to Balancing Domestic and International Sourcing

Complete supply chain domestication rarely makes economic sense. Strategic balance between domestic sourcing requirements for compliance-critical components and international sourcing for non-restricted categories optimizes both cost and federal market access. This balanced approach requires granular understanding of which components drive domestic content calculations and which fall outside regulatory scope.

Product architecture decisions affect compliance outcomes significantly. Designing products with modular structures that isolate foreign-sourced components from compliance-calculated assemblies creates flexibility while meeting Buy American requirements. Engineering teams should participate in compliance planning, understanding how design choices affect domestic content calculations and federal market eligibility.

Supplier diversification strategies must account for multi-tier supplier compliance challenges. Maintaining both domestic and international sources for critical components enables rapid supply chain pivots when domestic sourcing requirements shift. The manufacturing compliance automation approach supports this flexibility by tracking multiple supplier options and their implications for global supply chain compliance simultaneously.

Strategic Considerations:

Identify compliance-critical vs non-restricted component categories for domestic content calculations

Develop domestic supplier alternatives preventing Buy American compliance breakdown

Structure contracts preserving supply chain flexibility while meeting domestic sourcing requirements

Monitor regulatory changes affecting Buy American requirements

Invest in supplier development supporting multi-tier supplier compliance

Long-term supplier relationships with domestic manufacturers provide advantages beyond compliance qualification. Domestic suppliers face similar regulatory environments, reducing compliance education requirements and supply chain documentation gaps. Shorter supply chains simplify documentation collection and verification. These operational benefits complement the market access advantages of Buy American qualification.

The regulatory compliance challenges manufacturers face continue evolving. The 2026 threshold increase represents one milestone in an ongoing trend toward stricter domestic preference enforcement. Building compliance infrastructure today positions organizations to prevent federal contract violations and adapt as Buy American requirements intensify.

Securing Federal Market Access Through Proactive Compliance

The Buy American compliance breakdown points between federal requirements and global supply chains will not resolve themselves. Manufacturers who recognize these structural challenges and invest in global supply chain compliance infrastructure gain competitive advantages in federal procurement markets while competitors struggle with supply chain documentation gaps and audit findings.

Certivo's AI-powered compliance platform provides the infrastructure manufacturers need to bridge these gaps. From automated supplier data collection through CORA supporting multi-tier supplier compliance to compliance scoring that validates domestic content calculations, the platform addresses the specific breakdown points where global supply chains fail Buy American requirements. Human-in-the-loop compliance experts ensure accuracy while AI handles scale.

Federal procurement opportunities reward prepared organizations. Those who build compliance-ready supply chain infrastructure meeting all domestic sourcing requirements access contracts their competitors cannot pursue. Those who delay face increasing enforcement, tightening thresholds, federal contract violations, and diminishing market access.

Schedule a consultation with Certivo to assess your supply chain's Buy American compliance readiness and identify the specific breakdown points requiring attention before the 2026 threshold increases take effect.

Kunal Chopra

Kunal Chopra is the CEO of Certivo, an AI-driven compliance management platform revolutionizing how manufacturers navigate regulatory challenges. With a career spanning over two decades, Kunal is a seasoned technology leader, 3x tech CEO, product innovator, and board member with a passion for driving transformative growth and innovation.

Before leading Certivo, Kunal spearheaded successful transformations at renowned companies like Beckett Collectibles, Kaspien, Amazon, and Microsoft. His strategic vision and operational excellence have led to achievements such as a 25x EBITDA valuation increase at Beckett Collectibles and a 450% shareholder return at Kaspien. He has a track record of turning challenges into opportunities, delivering operational efficiencies, and driving market expansions.

Kunal’s deep expertise lies in blending technology and business strategy to create scalable solutions. At Certivo, he applies this expertise to empower manufacturers, using AI to turn product compliance from an operational burden into a strategic advantage.

Kunal holds an MBA from The University of Chicago Booth School of Business, an MS in Computer Science from Clemson University, and a BE in Computer Engineering from The University of Mumbai. When he’s not transforming businesses, Kunal is an advocate for innovation, growth, and building cultures that inspire excellence.

Stay tuned for insights from Kunal on how technology can redefine compliance, drive efficiency, and create opportunities for growth in the manufacturing sector.