Lavanya

Feb 3, 2026

The European Union has enacted a strict ban on intentionally added PFAS in food-contact packaging, establishing August 12, 2026, as the mandatory compliance deadline under the new Packaging and Packaging Waste Regulation. This regulation creates immediate EU food-contact packaging PFAS compliance obligations for manufacturers, importers, and suppliers across the food packaging value chain, with concentration thresholds representing some of the most stringent limits globally.

Published as Regulation (EU) 2025/40, the PPWR entered into force on February 11, 2025, replacing the longstanding Packaging Directive 94/62/EC with direct legal obligations across all 27 EU Member States. Organizations without robust regulatory change monitoring capabilities face market exclusion, documentation failures, and enforcement actions. Critically, there is no grandfathering provision, meaning even packaging manufactured before August 2026 cannot be placed on the EU market if it exceeds PFAS limits.

Table of Contents

Understanding the PPWR PFAS Restriction Framework

Concentration Limits and Testing Requirements

Key Deadlines and No-Grandfathering Rule

Documentation and Declaration of Conformity Requirements

High-Risk Product Categories and Common Hotspots

Business and Supply Chain Implications

Compliance Risks and Burden of Proof

Strategic Preparation Checklist for August 2026

How AI Transforms Packaging PFAS Compliance

Understanding the PPWR PFAS Restriction Framework

The Packaging and Packaging Waste Regulation represents a fundamental shift in European packaging compliance. Unlike the previous Packaging Directive 94/62/EC, which required member state transposition, the PPWR creates direct legal obligations that apply uniformly across all EU countries and EEA members without national implementation variations.

The EUR-Lex: Regulation (EU) 2025/40 (PPWR) establishes the authoritative legal framework for these restrictions. The regulation's PFAS provisions specifically target food-contact packaging as a central component of the EU's broader strategy to reduce hazardous substances in waste streams and protect human health from "forever chemicals."

EU food-contact packaging PFAS compliance requires understanding that this regulation addresses intentionally added PFAS rather than incidental contamination. Manufacturers who deliberately incorporate PFAS compounds for grease resistance, moisture barriers, or other functional properties face direct prohibition. This distinction affects how organizations assess packaging portfolios and prioritize reformulation investments.

The regulatory approach captures both polymeric and non-polymeric PFAS through tiered concentration limits, preventing manufacturers from substituting one PFAS type for another. Understanding PFAS compliance frameworks helps organizations navigate these complex requirements across multiple regulatory jurisdictions.

Concentration Limits and Testing Requirements

The PPWR establishes three specific concentration thresholds that food-contact packaging must not exceed. Understanding these PFAS concentration limits packaging requirements enables compliance teams to establish appropriate testing programs and supplier specifications.

PPWR PFAS Concentration Thresholds

Threshold Type | Limit | Measurement Method |

|---|---|---|

Individual non-polymeric PFAS | ≤ 25 ppb (parts per billion) | Targeted analysis |

Sum of non-polymeric PFAS | ≤ 250 ppb (parts per billion) | Targeted analysis |

Total PFAS (including polymeric) | ≤ 50 ppm (parts per million) | Total organic fluorine screening |

Individual PFAS Limit: 25 ppb

The strictest threshold applies to any single non-polymeric PFAS compound measured through targeted analytical methods. This limit requires manufacturers to evaluate packaging materials against comprehensive PFAS compound lists, as even trace contamination from individual substances can trigger non-compliance.

Sum of PFAS Limit: 250 ppb

The aggregate threshold captures total non-polymeric PFAS presence through targeted analysis. This approach prevents manufacturers from achieving individual compound compliance while maintaining problematic cumulative PFAS loads across multiple compounds.

Total PFAS Limit: 50 ppm

The broadest threshold includes polymeric PFAS substances and serves as both a compliance limit and a screening trigger. Products exceeding this threshold face immediate burden of proof requirements that shift documentation obligations to manufacturers.

Organizations must implement testing protocols addressing all three thresholds to ensure comprehensive EU food-contact packaging PFAS compliance. AI tools for compliance management help track testing results across packaging portfolios and identify non-conformances requiring remediation.

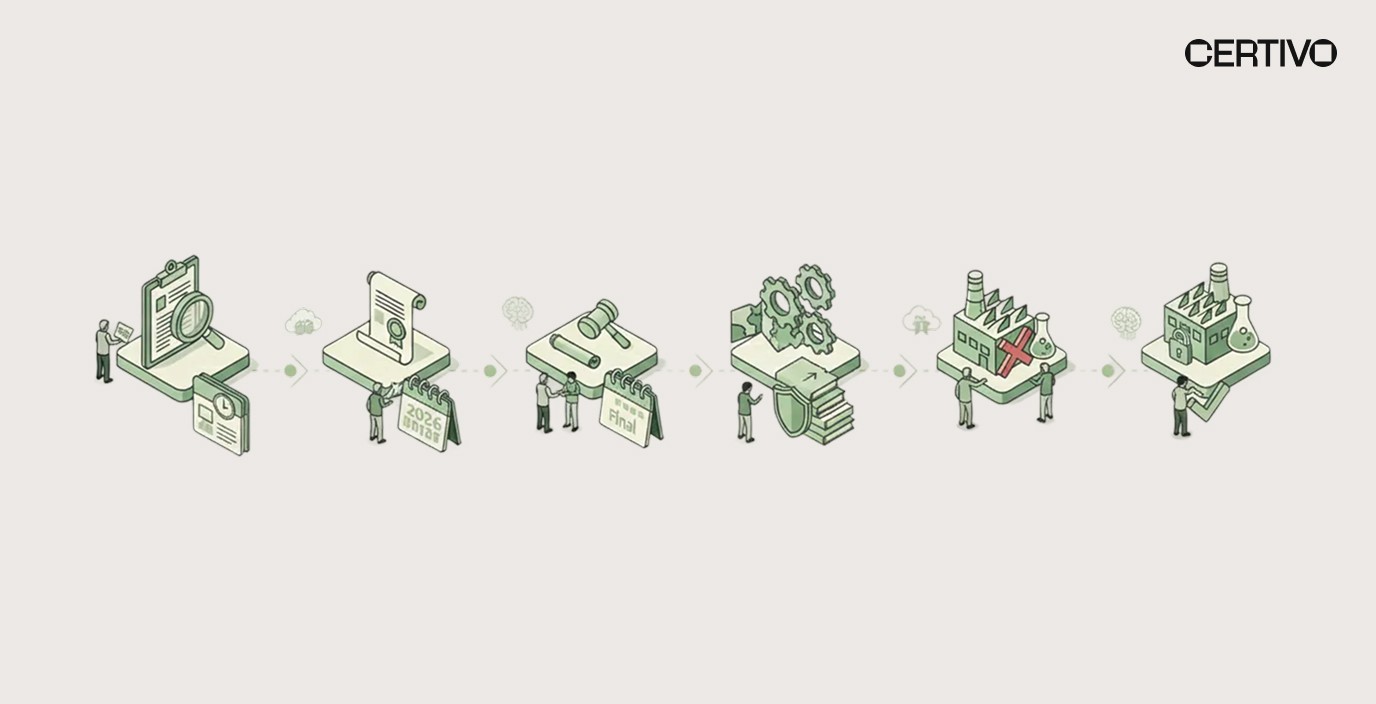

Key Deadlines and No-Grandfathering Rule

The food packaging PPWR regulations establish critical compliance milestones that organizations must track carefully. The absence of grandfathering provisions creates particularly significant implications for inventory management and production planning.

February 11, 2025: Entry Into Force

The PPWR officially entered into force on this date, establishing legal obligations and beginning the countdown to mandatory compliance. Organizations should have initiated compliance assessment activities following this milestone.

August 12, 2026: Mandatory Compliance Date

This date marks enforcement commencement for the PFAS ban in food-contact packaging. All packaging placed on the EU market after this date must meet concentration limits regardless of manufacturing date.

Critical: No Grandfathering Provision

Unlike many chemical restrictions that allow inventory clearance periods, the PPWR contains no grandfathering provision for existing stock. Even packaging manufactured before August 12, 2026, cannot be "placed on the market" (sold for the first time in the EU) if it exceeds PFAS limits.

This provision creates urgent implications:

Pre-manufactured inventory exceeding limits becomes unsaleable in EU markets

Production planning must account for reformulation timelines

Supply chain partners must align on compliant material transitions

Inventory write-off risks increase as deadline approaches

Proactive compliance risk management enables organizations to identify at-risk inventory and develop transition strategies before the deadline eliminates market access options.

Documentation and Declaration of Conformity Requirements

EU food-contact packaging PFAS compliance requires robust documentation systems that demonstrate ongoing conformity with concentration limits. The PPWR establishes specific Declaration of Conformity requirements that manufacturers must prepare and maintain.

Declaration of Conformity (DoC) Obligations

Manufacturers must prepare and maintain a Declaration of Conformity for all food-contact packaging placed on EU markets. This documentation must demonstrate that packaging meets all applicable PFAS concentration limits and must be available for enforcement authority review upon request.

Technical Documentation Requirements

Beyond the DoC, manufacturers must maintain comprehensive technical documentation supporting conformity claims. This documentation should include:

Testing results from accredited laboratories

Material composition specifications

Supplier declarations and certifications

Quality control procedures and records

Traceability documentation linking products to test results

Five-Year Retention Requirement

All documentation must be retained for at least five years from the date packaging is placed on the market. This retention period ensures regulatory authorities can verify compliance throughout enforcement activities and enables continuous audit-ready documentation practices.

Building future-ready compliance infrastructure supports documentation requirements that manual systems struggle to maintain at scale. Multi-tier supply chain transparency becomes essential when documentation must trace compliance from raw material suppliers through finished packaging.

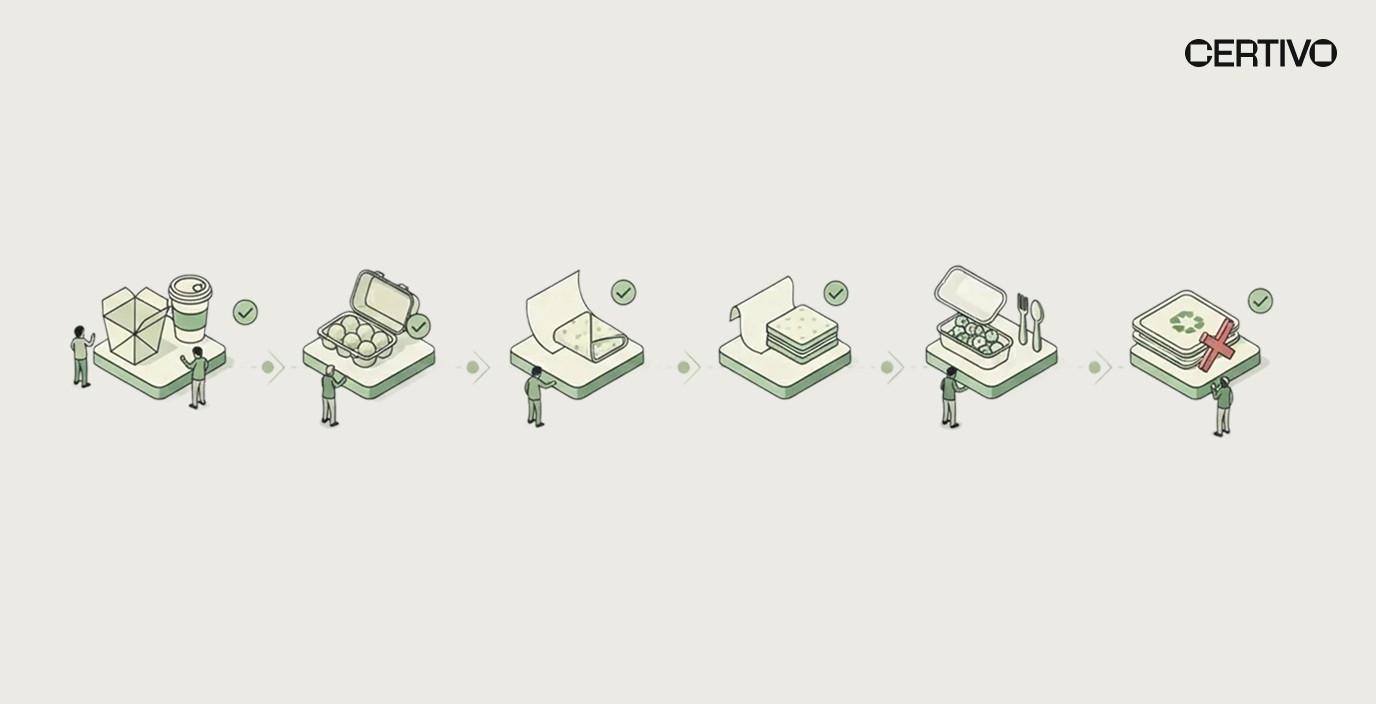

High-Risk Product Categories and Common Hotspots

The PPWR identifies specific food-contact packaging categories most likely to contain intentionally added PFAS. Organizations should prioritize compliance assessment for these common hotspots where forever chemicals packaging ban enforcement will likely focus.

Grease-Resistant Paper and Paperboard

Paper-based packaging designed for greasy or oily foods historically relies on PFAS treatments for moisture and oil barrier properties. These products represent primary compliance targets:

Fast-food wrappers and containers

Bakery bags and boxes

Deli paper and sandwich wraps

Takeaway food containers

Microwave Food Packaging

Microwave popcorn bags and other heat-resistant food packaging frequently incorporate PFAS compounds that provide grease resistance during heating. These products require careful evaluation against PFAS concentration limits packaging thresholds.

Pizza Boxes and Delivery Packaging

Corrugated pizza boxes and similar delivery packaging often contain PFAS treatments preventing grease migration. The food delivery sector's rapid growth has expanded this product category significantly.

Quick-Service Restaurant Packaging

Fast-food packaging across burger boxes, french fry containers, and salad bowls commonly incorporates PFAS for functional performance. Organizations serving quick-service restaurant customers face concentrated compliance exposure.

Procurement and supply chain leaders should evaluate supplier capabilities across these high-risk categories, identifying which partners can provide compliant alternatives and which require replacement.

Business and Supply Chain Implications

EU food-contact packaging PFAS compliance creates business consequences extending beyond direct regulatory obligations. Organizations must understand these implications to secure executive support for compliance investments and coordinate effectively across functional areas.

Market Access and Commercial Continuity

Packaging failing to meet PFAS concentration limits faces complete market exclusion from the European Union. For packaging manufacturers and food companies with significant EU revenue exposure, non-compliance threatens commercial viability rather than merely creating regulatory friction.

The no-grandfathering provision intensifies these stakes. Organizations cannot rely on inventory buffers or grace periods that other regulations provide. Market access ends definitively on August 12, 2026, for non-compliant products regardless of manufacturing date.

Supply Chain Reconfiguration

Global packaging supply chains may require significant reconfiguration to source PFAS-free materials. Suppliers unable or unwilling to meet food packaging PPWR regulations must be replaced, creating procurement challenges during transition periods.

Effective supplier collaboration enables early identification of supplier capabilities and gaps. Supplier risk scoring ecosystems help organizations prioritize engagement with critical partners requiring transition support.

Cost Implications

Compliance investment includes testing program establishment, potential material reformulation, supplier qualification, documentation system upgrades, and ongoing monitoring activities. Alternative materials may carry cost premiums during initial transition periods before market scale develops.

However, organizations implementing AI compliance software packaging solutions reduce ongoing compliance costs through automated regulatory monitoring PFAS capabilities that eliminate manual tracking inefficiencies.

Competitive Positioning

Early compliance achievement creates competitive advantages as the August 2026 deadline approaches. Organizations demonstrating EU food-contact packaging PFAS compliance can assure customers of continued supply while competitors struggle with non-compliant inventory and reformulation delays.

Compliance Risks and Burden of Proof

Non-compliance with PPWR PFAS restrictions carries significant enforcement consequences and creates documentation burdens that organizations must understand when evaluating compliance investment priorities.

Burden of Proof Shift

The regulation establishes a critical burden of proof mechanism. If testing reveals Total Organic Fluorine above 50 ppm, the burden shifts to the manufacturer or supplier to prove that the fluorine does not come from restricted PFAS compounds.

This provision creates significant implications:

Manufacturers cannot claim compliance without documentation

Testing revealing elevated fluorine triggers immediate proof requirements

Inability to demonstrate non-PFAS fluorine sources results in non-compliance determination

Documentation systems must support rapid response to enforcement inquiries

Market Withdrawal Requirements

Packaging exceeding PFAS concentration limits packaging thresholds faces mandatory market withdrawal. Withdrawal costs include logistics, customer notification, and potential replacement product provision. The reputational damage from enforcement actions may exceed direct withdrawal expenses.

Financial Penalties

EU member state enforcement includes authority to impose financial penalties for PPWR violations. Penalty amounts vary by jurisdiction and violation severity but can reach levels materially affecting organizational financial performance.

Customer and Stakeholder Consequences

Food brands sourcing non-compliant packaging face derivative regulatory exposure and reputational damage. Brand owners increasingly require continuous audit-ready documentation from packaging suppliers, creating commercial consequences that compound regulatory penalties.

Understanding why compliance teams should drive innovation helps organizations avoid enforcement consequences that reactive compliance approaches create.

Strategic Preparation Checklist for August 2026

Organizations should implement systematic preparation activities to achieve EU food-contact packaging PFAS compliance before the mandatory deadline. The following checklist provides framework for compliance program development.

Product Portfolio Assessment

Identify all food-contact packaging intended for EU market distribution

Screen materials for PFAS-containing treatments and coatings

Evaluate supply chain materials for potential PFAS contamination

Prioritize products by revenue exposure and reformulation complexity

Map inventory levels against no-grandfathering deadline implications

Testing Program Establishment

Identify accredited laboratories for PFAS testing

Establish testing protocols addressing all three concentration thresholds

Develop sample collection and handling procedures

Create result tracking and documentation systems

Implement ongoing monitoring for production consistency

Supplier Qualification and Transparency

Survey suppliers regarding PFAS content and alternatives

Collect material declarations and compliance certifications

Qualify alternative suppliers where current sources cannot comply

Establish multi-tier supply chain transparency protocols

Implement supplier risk scoring for ongoing monitoring

Documentation Systems

Implement Declaration of Conformity management systems

Establish technical documentation repositories

Create five-year retention protocols meeting regulatory requirements

Develop enforcement response procedures

Enable continuous audit-ready documentation capabilities

Compliance and regulation managers should coordinate these activities across functional areas to ensure comprehensive preparation before the August 2026 deadline.

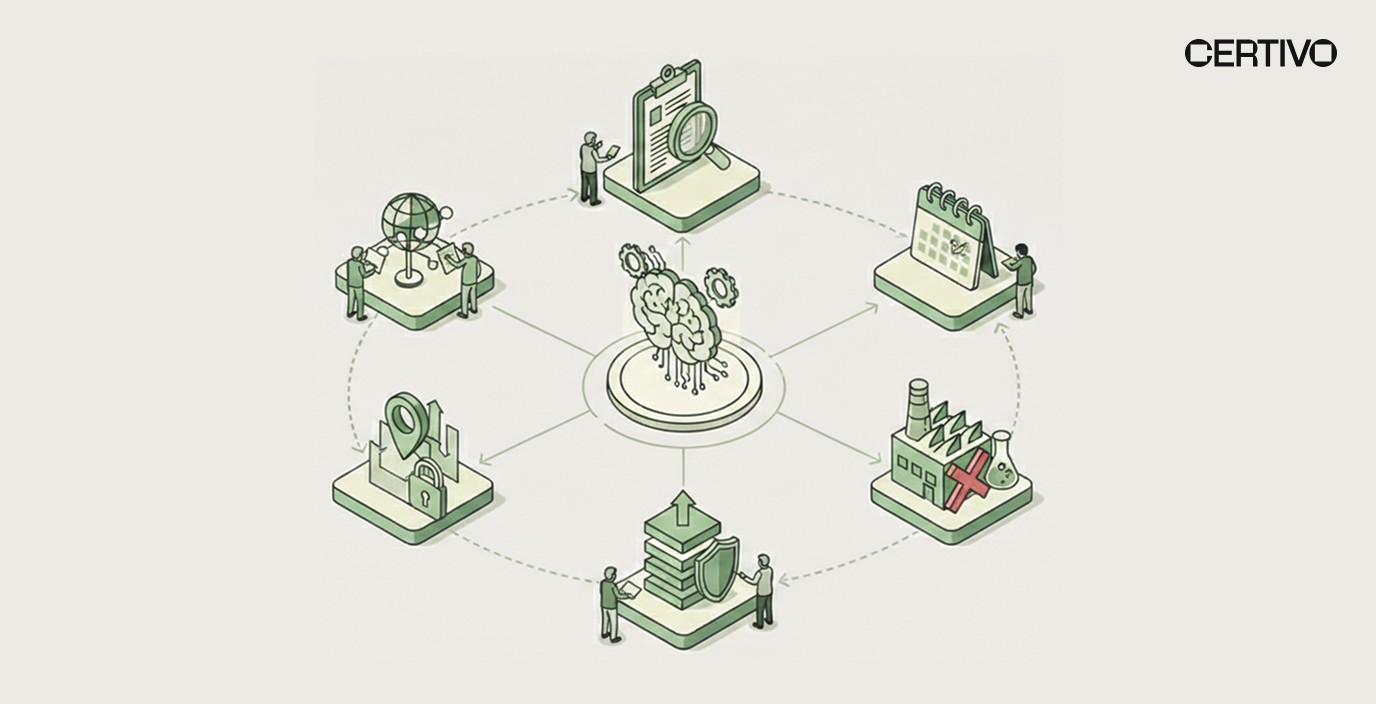

How AI Transforms Packaging PFAS Compliance

Manual compliance approaches cannot scale to address the complexity of EU food-contact packaging PFAS compliance across extensive packaging portfolios and global supply chains. AI compliance software packaging solutions fundamentally transform organizational capabilities for regulatory monitoring, testing management, and documentation maintenance.

Intelligent Regulatory Monitoring

PFAS regulatory landscapes evolve continuously across jurisdictions. The EU PPWR represents one element of broader global PFAS restrictions affecting packaging. Automated regulatory monitoring PFAS capabilities track developments across relevant markets, alerting compliance teams to changes requiring response through regulatory horizon scanning intelligence.

Understanding why people-only compliance cannot scale helps executives appreciate strategic value of AI-powered monitoring operating continuously across regulatory domains.

Automated Product Screening

Packaging portfolios spanning thousands of SKUs require systematic screening against PFAS concentration limits. AI platforms enable BOM-level compliance intelligence that identifies products requiring testing or reformulation within hours rather than weeks of manual review.

Global PFAS regulations compliance guidance provides frameworks for comprehensive PFAS compliance across markets beyond the EU.

Supply Chain Compliance Automation

AI-native compliance automation extends organizational visibility beyond internal operations to encompass supplier practices and material compositions. Platforms automate supplier data collection, verify compliance certifications, and flag gaps requiring remediation through centralized supplier self-service portals.

Certivo's platform incorporates CORA, an intelligent assistant that automates supplier follow-ups and data completion workflows. Rather than manual email chasing, CORA systematically engages suppliers to collect required documentation, reducing administrative burden while improving data completeness across standardized supplier questionnaire frameworks.

Continuous Documentation Management

Declaration of Conformity requirements demand continuous audit-ready documentation that evolves as testing results accumulate and regulations change. AI platforms maintain documentation systems meeting five-year retention requirements while enabling rapid response to enforcement authority inquiries.

Staying audit-ready across frameworks becomes systematic compliance practice rather than episodic scramble when AI systems manage documentation workflows.

Conclusion: Strategic Imperatives for August 2026 Readiness

The EU Packaging and Packaging Waste Regulation establishes one of the most stringent PFAS restrictions affecting food-contact packaging globally. The concentration limits of 25 ppb for individual PFAS, 250 ppb for sum of PFAS, and 50 ppm total PFAS create demanding thresholds that require systematic EU food-contact packaging PFAS compliance preparation before August 12, 2026.

The absence of grandfathering provisions elevates urgency beyond typical regulatory transitions. Organizations cannot rely on inventory clearance periods or phase-in schedules. All food-contact packaging placed on EU markets after the deadline must meet concentration limits regardless of manufacturing date, creating immediate implications for production planning, inventory management, and supply chain coordination.

Declaration of Conformity requirements and five-year documentation retention obligations demand robust systems that manual processes struggle to maintain at scale. The burden of proof shift when Total Organic Fluorine exceeds 50 ppm means organizations must maintain documentation capable of demonstrating compliance upon enforcement authority request.

The business consequences of non-compliance extend beyond regulatory penalties to include EU market exclusion, supply chain disruption, and reputational damage affecting customer relationships and investor confidence. Organizations recognizing these stakes invest in AI compliance software packaging solutions that automate regulatory monitoring, testing management, and documentation systems.

Executive leadership must recognize that food packaging PPWR regulations represent ongoing operational reality rather than one-time project. Building robust compliance infrastructure today positions organizations to address not only the August 2026 PFAS deadline but continuing evolution of EU packaging requirements that will follow.

Schedule a consultation with Certivo to assess your organization's EU food-contact packaging PFAS compliance readiness and develop AI-powered strategies ensuring continued market access while reducing compliance operational burden.

Lavanya

Lavanya is an accomplished Product Compliance Engineer with over four years of expertise in global environmental and regulatory frameworks, including REACH, RoHS, Proposition 65, POPs, TSCA, PFAS, CMRT, FMD, and IMDS. A graduate in Chemical Engineering from the KLE Institute, she combines strong technical knowledge with practical compliance management skills across diverse and complex product portfolios.

She has extensive experience in product compliance engineering, ensuring that materials, components, and finished goods consistently meet evolving international regulatory requirements. Her expertise spans BOM analysis, material risk assessments, supplier declaration management, and test report validation to guarantee conformity. Lavanya also plays a key role in design-for-compliance initiatives, guiding engineering teams on regulatory considerations early in the product lifecycle to reduce risks and streamline market access.

Her contributions further extend to compliance documentation, certification readiness, and preparation of customer deliverables, ensuring transparency and accuracy for global stakeholders. She is adept at leveraging compliance tools and databases to efficiently track regulatory changes and implement proactive risk mitigation strategies.

Recognized for her attention to detail, regulatory foresight, and collaborative approach, Lavanya contributes significantly to maintaining product compliance, safeguarding brand integrity, and advancing sustainability goals within dynamic, globally integrated manufacturing environments.