Lavanya

Feb 4, 2026

The European Union's landmark restriction on intentionally added microplastics enters a decisive phase in 2026, establishing mandatory annual reporting requirements that transform compliance from product reformulation into ongoing environmental accountability. Entry 78 of REACH Annex XVII creates comprehensive EU microplastics ban compliance requirements affecting manufacturers across cosmetics, detergents, agriculture, and industrial sectors still operating under transitional exemptions.

Published on September 25, 2023, and implemented from October 17, 2023, this regulation has already prohibited microplastics in numerous product categories. However, the May 31, 2026 deadline introduces granular ECHA reporting obligations requiring detailed emission estimates and microplastic identity data. Organizations dependent on manual compliance tracking face documentation burdens that intelligent compliance platforms can systematically address before reporting deadlines arrive.

Table of Contents

Understanding REACH Annex XVII Microplastics Restriction

Complete Regulatory Framework: Annex XVII Entry 78

Key Deadlines and 2026 Reporting Requirements

Industries Facing Direct Compliance Impact

Reformulation and Labelling Obligations

Business and Supply Chain Implications

Compliance Risks and Enforcement Consequences

Strategic Preparation Checklist for 2026

How AI Transforms Microplastics Compliance Management

Understanding REACH Annex XVII Microplastics Restriction

The REACH Annex XVII microplastics restriction represents the European Union's most comprehensive regulatory response to synthetic polymer pollution. This framework establishes a broad prohibition on the intentional addition of microplastics to products, addressing environmental persistence that allows these materials to accumulate in ecosystems, food chains, and human tissue over extended periods.

The ECHA Microplastics Restriction Overview provides authoritative guidance on Entry 78 requirements. The European Commission and ECHA developed this restriction based on substantial scientific evidence linking synthetic polymer microparticles to toxicological and physical effects on organisms across marine and terrestrial environments.

EU microplastics ban compliance requirements target "intentional addition" rather than incidental contamination. Manufacturers deliberately incorporating synthetic polymers for functional purposes face direct compliance obligations, while trace contamination from manufacturing processes generally falls outside regulatory scope. This distinction fundamentally affects how organizations assess product portfolios and prioritize reformulation investments.

The regulation's phased implementation acknowledges industry transition challenges while establishing clear timelines for complete elimination. Product categories without viable alternatives received transitional periods, but these exemptions carry mandatory reporting and labelling obligations that escalate compliance complexity significantly. Proactive compliance risk management enables organizations to navigate these transitional requirements systematically.

Complete Regulatory Framework: Annex XVII Entry 78

Understanding the complete technical parameters governing regulated microplastics proves essential for accurate compliance assessment. The following table provides the authoritative regulatory framework established under REACH Annex XVII synthetic polymers restrictions.

REACH Annex XVII Entry 78: Microplastics Restriction Summary

Feature | Details |

|---|---|

Chemical Scope | Synthetic Polymer Microparticles (SPMs) |

Structural Definition | Solid, carbon-based synthetic polymer particles that are: |

• Size: Diameter ≤ 5 mm | |

• Fibers: Length ≤ 15 mm (with length-to-diameter ratio > 3) | |

• Solubility: ≤ 2 g/L (unless proven higher) | |

• Biodegradability: Non-biodegradable (as per specific technical criteria in Appendices 15 & 16) | |

Proposing Authority | European Commission / ECHA (European Chemicals Agency) |

Hazard & Concern | Environmental Persistence: Resistant to degradation, leading to accumulation in ecosystems, food chains, and human tissue. Linked to toxicological and physical effects on organisms. |

Application (Uses) | • Consumer: Exfoliants (microbeads), glitters, makeup, lip/nail products, detergents, fabric softeners, encapsulated fragrances |

• Industrial: Abrasive blasting, binders, processing aids at industrial sites | |

• Others: Granular infill for artificial turf, agricultural coatings for fertilizers/seeds, medicinal products | |

Regulatory Limit | Prohibited for sale as a substance or in mixtures if concentration is ≥ 0.01% by weight (unless a transition period or derogation applies) |

2026 Reporting Duty | Manufacturers and industrial downstream users of pellets, flakes, and powders used as feedstock must submit their first annual emission report to ECHA by May 31, 2026 (covering 2025 data) |

This comprehensive framework establishes the technical boundaries that determine whether specific materials and products fall within EU microplastics ban compliance requirements. Organizations must evaluate formulations against these criteria to identify items requiring reformulation, reporting, or market withdrawal. AI tools for compliance management help screen extensive product catalogs against technical criteria efficiently.

Key Deadlines and 2026 Reporting Requirements

The microplastics restriction framework establishes multiple compliance milestones that organizations must track carefully. The 2026 reporting cycle marks significant escalation in documentation requirements for manufacturers operating under transitional exemptions.

May 31, 2026: First Mandatory ECHA Reporting Deadline

Manufacturers and industrial downstream users of pellets, flakes, and powders used as feedstock must submit their first annual emission report to ECHA by this date. Reports must cover 2025 calendar year data, meaning organizations should already be establishing data collection systems for microplastics ECHA reporting obligations.

Required reporting elements include:

Descriptions of specific uses of microplastics in products

Estimates of quantity of microplastics released to the environment during the previous calendar year

Identification of microplastic types and characteristics

Documentation of measures implemented to minimize environmental release

Implementation Timeline Overview

Milestone | Date | Requirement |

|---|---|---|

Regulation Published | September 25, 2023 | Official Journal publication |

Implementation Commenced | October 17, 2023 | Immediate bans for certain categories |

First Reporting Cycle | May 31, 2026 | Annual emission reports covering 2025 data |

Ongoing Reporting | Annually thereafter | Continued environmental release tracking |

Organizations relying on manual compliance tracking face overwhelming documentation burdens as microplastics ECHA reporting obligations compound with existing regulatory requirements. Building future-ready compliance infrastructure addresses these challenges systematically.

Industries Facing Direct Compliance Impact

EU microplastics ban compliance requirements create varying obligations across industries based on product characteristics, transitional exemption status, and reformulation complexity. Executive leadership should evaluate organizational exposure within the following sector categories.

Detergents and Maintenance Products

Manufacturers of encapsulated scents, fabric softeners, and waxes face significant microplastics reformulation manufacturers challenges. Encapsulation technology using synthetic polymer shells must transition to biodegradable or soluble alternatives meeting strict ECHA criteria. The functional benefits these polymers provide require substantial R&D investment to replicate through compliant chemistries.

Cosmetics and Personal Care

The cosmetics sector faces particularly complex EU microplastics ban compliance requirements across fragrances, glitters, and leave-on products. Microbeads used in exfoliating products faced early prohibition, but decorative glitters and polymer-based product matrices remain under transitional arrangements requiring reporting and labelling compliance.

Global cosmetics industry regulatory shifts extend beyond microplastics to encompass PFAS and other emerging restrictions. Cosmetics microplastics regulations EU requirements demand particular attention to leave-on products where consumer exposure occurs over extended periods.

Agriculture

Coated fertilizers, treated seeds, and pesticides relying on synthetic polymer coatings face extended transitional periods reflecting unique reformulation challenges. However, these exemptions carry mandatory reporting obligations requiring detailed tracking of environmental releases. The scale of agricultural applications means synthetic polymer microparticles restriction compliance affects substantial product volumes.

Industrial Sites

Processing aids, binders, and abrasive blasting materials used at industrial sites face reporting requirements even where direct consumer exposure is limited. Industrial microplastics compliance tracking must address both product-related and process-related synthetic polymer uses across manufacturing operations. Industrial automation compliance frameworks provide models for managing these requirements.

Sports and Recreation

Granular infill for artificial turf pitches represents one of the most significant volume applications of synthetic polymer microparticles. This sector faces extended transition periods but must implement containment measures and report environmental releases while alternatives are developed.

Medical and Pharmaceuticals

Specialized drug delivery systems and diagnostic tools utilizing microplastics receive specific derogations reflecting healthcare importance. Manufacturers must maintain documentation demonstrating derogation eligibility and comply with applicable labelling requirements. Medical devices industry compliance frameworks provide models for managing specialized requirements.

Reformulation and Labelling Obligations

Beyond reporting requirements, EU microplastics ban compliance requirements impose active reformulation duties and specific labelling obligations for products remaining on the market under transitional arrangements.

Reformulation Requirements

Manufacturers must actively phase out restricted particles or reformulate using biodegradable or soluble alternatives meeting strict ECHA criteria. This requirement moves beyond mere compliance documentation to mandate actual product changes within specified timeframes.

Microplastics reformulation manufacturers face several challenges:

Identifying biodegradable alternatives providing equivalent functionality

Validating alternative materials against ECHA biodegradability criteria in Appendices 15 and 16

Scaling production of reformulated products

Managing inventory transitions during reformulation periods

Communicating changes to customers and supply chain partners

Supplier collaboration capabilities prove essential when reformulation requires new material sourcing or alternative supplier qualification.

Labelling and Instructions for Use

Products containing microplastics not yet banned under transitional arrangements must display specific instructions for use and disposal. This labelling requirement guides end-users in preventing environmental leakage during product use and disposal phases.

Labelling must address:

Clear identification that product contains synthetic polymer microparticles

Instructions for proper use minimizing environmental release

Disposal guidance preventing environmental contamination

Additional information required by specific product category regulations

Business and Supply Chain Implications

EU microplastics ban compliance requirements create business consequences extending beyond direct regulatory obligations. Organizations must understand these implications to secure executive support for compliance investments.

Market Access and Commercial Continuity

Products failing to meet concentration limits or reporting requirements face market exclusion from the European Union. The 0.01% concentration threshold demands rigorous formulation control and testing verification. Expanding into new markets requires compliance readiness that enables rather than constrains commercial growth.

Supply Chain Reconfiguration

Global supply chains may require reconfiguration to source compliant alternative materials. Suppliers unable to provide biodegradable or soluble alternatives meeting ECHA criteria must be replaced. Automated environmental emission reporting capabilities must extend across supply chains to capture data needed for ECHA submissions.

Streamlined supplier documentation processes ensure vendors provide material composition and environmental release data required for reporting compliance.

Cost Implications

Compliance investment includes reformulation R&D, alternative material qualification, testing program establishment, reporting system implementation, and ongoing monitoring. Organizations implementing AI compliance software chemicals reduce ongoing costs by automating data collection, reporting, and supplier management.

Competitive Positioning

Early compliance achievement creates competitive advantages as reporting deadlines approach. Organizations demonstrating REACH Annex XVII synthetic polymers compliance can position products as environmentally responsible while competitors manage transitional challenges.

Compliance Risks and Enforcement Consequences

Non-compliance with REACH Annex XVII microplastics restrictions carries significant enforcement consequences that organizations must understand when evaluating compliance investment priorities.

Market Withdrawal Requirements

Products exceeding concentration limits or failing to meet reporting obligations face mandatory market withdrawal. Withdrawal costs include logistics, customer notification, and potential replacement product provision. Reputational damage from public enforcement actions may exceed direct withdrawal expenses.

Financial Penalties

EU member state enforcement authorities possess power to impose financial penalties for REACH violations. Penalty amounts vary by jurisdiction and violation severity but can reach levels materially affecting organizational financial performance.

Reporting Failures

Organizations failing to submit required ECHA reports by May 31, 2026 face enforcement actions distinct from product-related violations. Reporting failures demonstrate systemic compliance deficiencies that regulators interpret as indicative of broader problems.

Understanding why compliance teams should drive innovation helps organizations avoid enforcement consequences that reactive compliance approaches create.

Strategic Preparation Checklist for 2026

Organizations should implement systematic preparation activities to achieve and maintain EU microplastics ban compliance requirements.

Product Portfolio Assessment

Identify all products containing synthetic polymer microparticles

Evaluate concentration levels against 0.01% threshold

Determine transitional exemption applicability and expiration dates

Prioritize products by reformulation complexity and revenue exposure

Reporting System Establishment

Implement data collection systems for 2025 calendar year

Establish environmental release estimation methodologies

Create documentation protocols for microplastic identity tracking

Develop ECHA submission procedures and internal review processes

Reformulation Planning

Identify biodegradable and soluble alternatives meeting ECHA Appendices 15 and 16 criteria

Qualify alternative materials through testing and validation

Develop reformulation timelines aligned with transitional period expirations

Plan inventory transitions minimizing stranded stock

Supplier Qualification

Survey suppliers regarding microplastic content and alternatives

Collect material declarations and compliance certifications

Qualify alternative suppliers where current sources cannot comply

Establish ongoing monitoring for supplier compliance status

Procurement and supply chain leaders should coordinate supplier qualification activities across vendor networks.

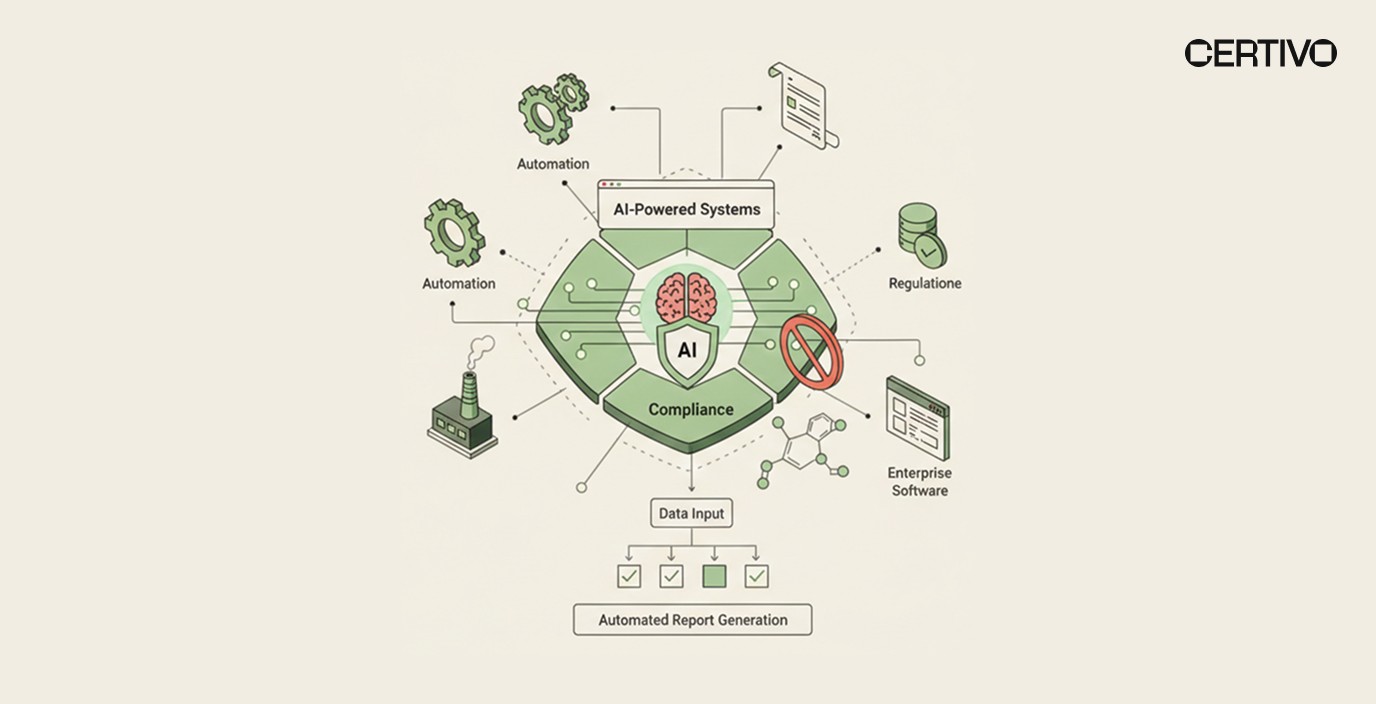

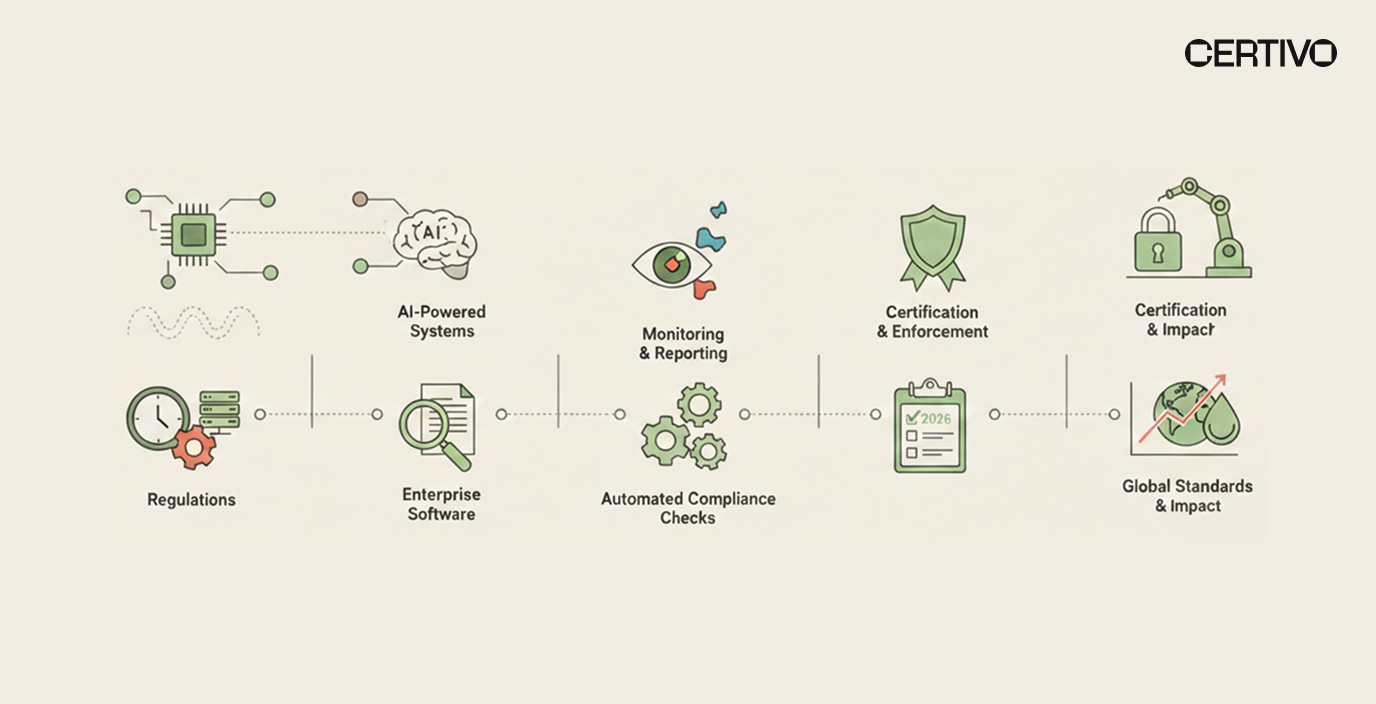

How AI Transforms Microplastics Compliance Management

Manual compliance approaches cannot scale to address the complexity of EU microplastics ban compliance requirements across extensive product portfolios and global supply chains. AI compliance software chemicals fundamentally transforms organizational capabilities for regulatory monitoring, reporting automation, and documentation management.

Intelligent Regulatory Monitoring

Microplastics regulatory landscapes evolve as ECHA issues guidance updates, member states clarify enforcement approaches, and scientific understanding advances. Automated regulatory monitoring capabilities track developments across relevant jurisdictions, alerting compliance teams to changes requiring response.

Understanding why people-only compliance cannot scale helps executives appreciate strategic value of AI-powered monitoring operating continuously across regulatory domains.

Automated Environmental Emission Reporting

The microplastics ECHA reporting obligations demand granular data on microplastic identities and environmental release estimates. Automated environmental emission reporting capabilities aggregate data from across operations, calculate release estimates using approved methodologies, and format submissions meeting ECHA requirements.

Industrial microplastics compliance tracking becomes manageable when AI systems handle data aggregation and reporting generation. Manual approaches requiring spreadsheet compilation across multiple facilities create error risks that automated systems eliminate.

Supply Chain Data Collection

Microplastics ECHA reporting obligations require supply chain visibility extending beyond internal operations. AI platforms automate supplier data collection, verify compliance certifications, and flag gaps requiring remediation.

Certivo's platform incorporates CORA, an intelligent assistant that automates supplier follow-ups and data completion workflows. Rather than manual email chasing, CORA systematically engages suppliers to collect material composition and environmental release data required for reporting compliance.

Audit-Ready Documentation

Compliance documentation must demonstrate current practices aligned with REACH Annex XVII synthetic polymers requirements. AI platforms maintain audit-ready documentation evolving as regulations change. Staying audit-ready across frameworks becomes systematic compliance practice rather than episodic scramble.

Conclusion: Strategic Imperatives for 2026 Compliance Readiness

The REACH Annex XVII microplastics restriction represents a fundamental shift in how the European Union addresses synthetic polymer pollution. The May 31, 2026 reporting deadline transforms EU microplastics ban compliance requirements from product reformulation into ongoing environmental accountability demanding systematic data collection, emission estimation, and regulatory submission capabilities.

Organizations across detergents, cosmetics, agriculture, industrial, sports, and medical sectors must evaluate product portfolios against the 0.01% concentration threshold while establishing reporting systems capturing 2025 calendar year data. The technical definitions governing synthetic polymer microparticles require careful analysis to identify affected products and prioritize compliance investments.

The business consequences of non-compliance extend beyond regulatory penalties to include EU market exclusion, supply chain disruption, and reputational damage. Organizations recognizing these stakes invest in AI compliance software chemicals that automates regulatory monitoring, emission reporting, and documentation management.

Microplastics reformulation manufacturers face the dual challenge of developing compliant alternatives while maintaining product performance. Early reformulation investment positions organizations competitively as transitional periods expire and full prohibition takes effect.

Executive leadership must recognize that EU microplastics ban compliance requirements represent ongoing operational reality rather than one-time project. The annual ECHA reporting obligation creates perpetual compliance demands that manual processes cannot reliably sustain across extensive product portfolios.

Explore how AI-driven compliance can support your microplastics reporting readiness and develop strategies ensuring continued EU market access while reducing compliance operational burden.

Lavanya

Lavanya is an accomplished Product Compliance Engineer with over four years of expertise in global environmental and regulatory frameworks, including REACH, RoHS, Proposition 65, POPs, TSCA, PFAS, CMRT, FMD, and IMDS. A graduate in Chemical Engineering from the KLE Institute, she combines strong technical knowledge with practical compliance management skills across diverse and complex product portfolios.

She has extensive experience in product compliance engineering, ensuring that materials, components, and finished goods consistently meet evolving international regulatory requirements. Her expertise spans BOM analysis, material risk assessments, supplier declaration management, and test report validation to guarantee conformity. Lavanya also plays a key role in design-for-compliance initiatives, guiding engineering teams on regulatory considerations early in the product lifecycle to reduce risks and streamline market access.

Her contributions further extend to compliance documentation, certification readiness, and preparation of customer deliverables, ensuring transparency and accuracy for global stakeholders. She is adept at leveraging compliance tools and databases to efficiently track regulatory changes and implement proactive risk mitigation strategies.

Recognized for her attention to detail, regulatory foresight, and collaborative approach, Lavanya contributes significantly to maintaining product compliance, safeguarding brand integrity, and advancing sustainability goals within dynamic, globally integrated manufacturing environments.