Lavanya

Feb 2, 2026

The European Chemicals Agency has confirmed that formaldehyde and formaldehyde-releasing substances will join the REACH Annex XVII restricted substances list, with enforcement beginning August 6, 2026. This regulatory expansion creates immediate REACH Annex XVII formaldehyde compliance obligations for manufacturers across furniture, construction, textiles, automotive, and consumer goods sectors seeking continued EU market access.

The emission limits represent some of the most stringent formaldehyde restrictions globally. Furniture and wood-based articles must not exceed 0.062 mg/m³, while other articles face a threshold of 0.080 mg/m³. Organizations without robust regulatory change monitoring capabilities risk market exclusion, product recalls, and reputational damage that undermines years of brand investment. Understanding these requirements now enables strategic preparation rather than reactive scrambling as the deadline approaches.

Table of Contents

Understanding the REACH Annex XVII Formaldehyde Amendment

Emission Limits Explained: Technical Requirements for Compliance

Industries Facing Direct Compliance Impact

Business and Supply Chain Implications

Compliance Risks and Enforcement Consequences

Timeline to August 2026: Strategic Preparation Roadmap

How AI Transforms REACH Compliance Management

Building Compliance Infrastructure for Formaldehyde Restrictions

Understanding the REACH Annex XVII Formaldehyde Amendment

The REACH regulation establishes the European Union's comprehensive framework for chemical substance management, with Annex XVII specifically addressing restrictions on hazardous substances in articles placed on the EU market. The addition of formaldehyde to this annex reflects growing scientific consensus regarding health risks associated with indoor air exposure to formaldehyde emissions from consumer products and building materials.

Formaldehyde, classified as a Group 1 carcinogen by the International Agency for Research on Cancer, poses documented risks including respiratory irritation, sensitization, and cancer with prolonged exposure. The European Chemicals Agency REACH documentation provides the authoritative legal framework governing these restrictions.

The amendment addresses both formaldehyde itself and formaldehyde-releasing substances, recognizing that many manufacturing processes incorporate resins and adhesives that continue releasing formaldehyde throughout product lifecycles. This comprehensive approach ensures REACH Annex XVII formaldehyde compliance requires attention to material composition, manufacturing processes, and finished product emissions rather than simple ingredient substitution.

Once ECHA approves substances for restriction, they are formally added to regulatory lists that trigger compliance obligations across supply chains. Organizations must understand that REACH restricted substances compliance extends beyond direct manufacturers to include importers, distributors, and downstream users placing articles on EU markets. This supply chain scope creates compliance dependencies that effective supplier collaboration must address systematically.

Emission Limits Explained: Technical Requirements for Compliance

The formaldehyde emission limits EU regulators have established represent specific, measurable thresholds that products must meet through validated testing protocols. Understanding these technical requirements enables compliance teams to establish appropriate testing programs and supplier specifications.

Furniture and Wood-Based Articles: 0.062 mg/m³

The stricter threshold applies to furniture and wood-based articles, reflecting the substantial surface area these products present in indoor environments and their proximity to occupants during extended periods. This formaldehyde emission limit aligns with E1 classification standards familiar to wood products manufacturers but incorporates specific testing methodology requirements under REACH.

Products within this category include:

Residential and commercial furniture

Kitchen cabinets and bathroom vanities

Wood flooring and wall panels

Shelving and storage systems

Bed frames and mattress foundations

The 0.062 mg/m³ threshold requires manufacturers to evaluate adhesive systems, surface treatments, and raw material specifications against emission performance. Many existing formulations may require reformulation or process modifications to achieve consistent compliance. AI tools for compliance management help organizations track which products require testing and reformulation across extensive portfolios.

Other Articles: 0.080 mg/m³

The 0.080 mg/m³ threshold applies to articles outside furniture and wood-based categories, including textiles, automotive interior components, and various consumer goods containing formaldehyde-releasing substances. While marginally less stringent than furniture requirements, this limit still demands systematic attention to material composition and manufacturing processes.

Products within this category include:

Textile products and apparel

Automotive interior trim and seating

Consumer electronics housings

Household goods and accessories

Building materials beyond wood products

Organizations must implement formaldehyde testing requirements protocols that verify compliance before products reach EU markets. Testing must follow standardized methodologies that ECHA recognizes, typically involving chamber testing that measures emissions under controlled conditions simulating actual use environments.

Industries Facing Direct Compliance Impact

REACH Annex XVII formaldehyde compliance creates varying obligations across industries based on product characteristics, material compositions, and supply chain structures. Executive leadership should evaluate organizational exposure within the following sector categories.

Furniture Manufacturing

Furniture manufacturers face the most stringent formaldehyde emission limits EU regulators have established. The 0.062 mg/m³ threshold requires comprehensive evaluation of adhesive systems used in composite wood products, upholstery treatments, and surface finishes. Organizations manufacturing for EU markets must establish testing programs that verify emission compliance across product lines.

The furniture industry's reliance on urea-formaldehyde and phenol-formaldehyde resins in particleboard, MDF, and plywood creates inherent compliance challenges. Alternative adhesive technologies exist but may require capital investment, process modifications, and supplier qualification activities. Proactive compliance risk management enables early identification of products requiring reformulation.

Construction and Wood Products

Construction materials including flooring, wall panels, insulation products, and structural wood components face REACH restricted substances compliance obligations affecting both residential and commercial building projects. The construction industry's extended product lifecycles and installation permanence elevate compliance significance, as non-compliant materials may require costly removal and replacement.

Construction and building materials manufacturers must coordinate with distributors and contractors to ensure compliant products reach EU construction sites. Supply chain documentation must demonstrate compliance throughout distribution channels.

Textiles and Apparel

Textile manufacturers using formaldehyde-based finishing treatments for wrinkle resistance, shrinkage control, and durable press properties face the 0.080 mg/m³ emission threshold. These treatments have been industry standards for decades, and reformulation may affect product performance characteristics that customers expect.

The global textile supply chain's complexity creates particular challenges for REACH Annex XVII formaldehyde compliance. Finishing treatments often occur at facilities distant from brand owners, requiring streamlined supplier documentation processes that verify compliance across international supplier networks.

Automotive Interiors

Automotive manufacturers face EU chemical restrictions for interior components including seating, headliners, door panels, and dashboard assemblies. Vehicle interior air quality has become an increasing concern, with formaldehyde emissions contributing to "new car smell" that customers may find objectionable and regulators now restrict.

The automotive industry compliance framework must incorporate formaldehyde restrictions alongside existing regulatory requirements for safety, emissions, and environmental performance. Integration across compliance domains prevents fragmented approaches that increase costs and complexity.

Consumer Goods

Diverse consumer goods categories including household products, personal care packaging, toys, and electronics face the 0.080 mg/m³ threshold. The breadth of affected products requires systematic portfolio assessment to identify items containing formaldehyde-releasing substances.

Organizations selling consumer goods into EU markets must implement automated regulatory monitoring systems that track which products require compliance verification and testing. Manual tracking across extensive product catalogs creates compliance gaps that enforcement actions may exploit.

Business and Supply Chain Implications

REACH Annex XVII formaldehyde compliance creates business consequences extending beyond direct regulatory obligations. Organizations must understand these implications to secure executive support for compliance investments and coordinate effectively across functional areas.

Market Access and Commercial Continuity

Products failing to meet formaldehyde emission limits face market exclusion from the European Union, representing one of the world's largest consumer markets. For manufacturers with significant EU revenue exposure, non-compliance threatens commercial viability rather than merely creating regulatory friction.

The August 2026 deadline provides limited time for organizations to reformulate products, qualify alternative materials, establish testing programs, and update supply chain documentation. Organizations delaying compliance preparation risk missing the deadline and facing temporary or permanent EU market exclusion. Expanding into new markets requires compliance readiness that enables rather than constrains commercial growth.

Supply Chain Reconfiguration

Global supply chains may require reconfiguration to source compliant materials and components. Suppliers unable or unwilling to meet REACH restricted substances compliance requirements must be replaced, creating procurement challenges and potential supply disruptions during transition periods.

Procurement and supply chain leaders should evaluate supplier capabilities now, identifying which partners can support compliance and which require replacement. Early supplier qualification prevents last-minute scrambles that compromise quality, cost, and delivery performance.

Cost Implications

Compliance investment includes testing program establishment, potential product reformulation, supplier qualification, documentation system upgrades, and ongoing monitoring activities. These costs vary significantly based on organizational size, product portfolio complexity, and current compliance maturity.

Organizations implementing AI compliance software for chemicals reduce ongoing compliance costs by automating monitoring, documentation, and supplier management activities. While initial platform investment is required, operational efficiency gains typically generate positive return on investment within the first compliance cycle.

Competitive Positioning

Early compliance achievement creates competitive advantages as the August 2026 deadline approaches. Organizations demonstrating REACH Annex XVII formaldehyde compliance can assure customers of continued supply while competitors struggle with compliance gaps. This positioning proves particularly valuable in B2B relationships where supply continuity affects customer operations.

Compliance Risks and Enforcement Consequences

Non-compliance with REACH restricted substances carries significant enforcement consequences that organizations must understand when evaluating compliance investment priorities. EU member states enforce REACH requirements through national competent authorities with powers including market surveillance, product testing, and enforcement actions.

Product Recalls and Market Withdrawal

Products exceeding formaldehyde emission limits face mandatory market withdrawal and potential recall requirements. Recall costs include logistics, customer notification, replacement product provision, and reputational damage that may exceed direct recall expenses significantly.

Financial Penalties

Member state enforcement includes authority to impose financial penalties for REACH violations. Penalty amounts vary by jurisdiction and violation severity but can reach levels that materially affect organizational financial performance. Repeated violations may trigger enhanced scrutiny and escalating penalties.

Import Restrictions

Importers placing non-compliant articles on EU markets face enforcement actions that may include import restrictions. Organizations relying on third-country manufacturing must ensure supplier compliance to prevent border rejections that disrupt supply chains and customer relationships.

Reputational Damage

Enforcement actions become public record, creating reputational damage that affects customer relationships, investor confidence, and talent recruitment. Organizations publicly cited for REACH violations face questions about overall compliance culture and operational integrity.

Understanding why compliance teams should drive innovation rather than merely checking boxes helps organizations avoid the enforcement consequences that reactive compliance approaches create.

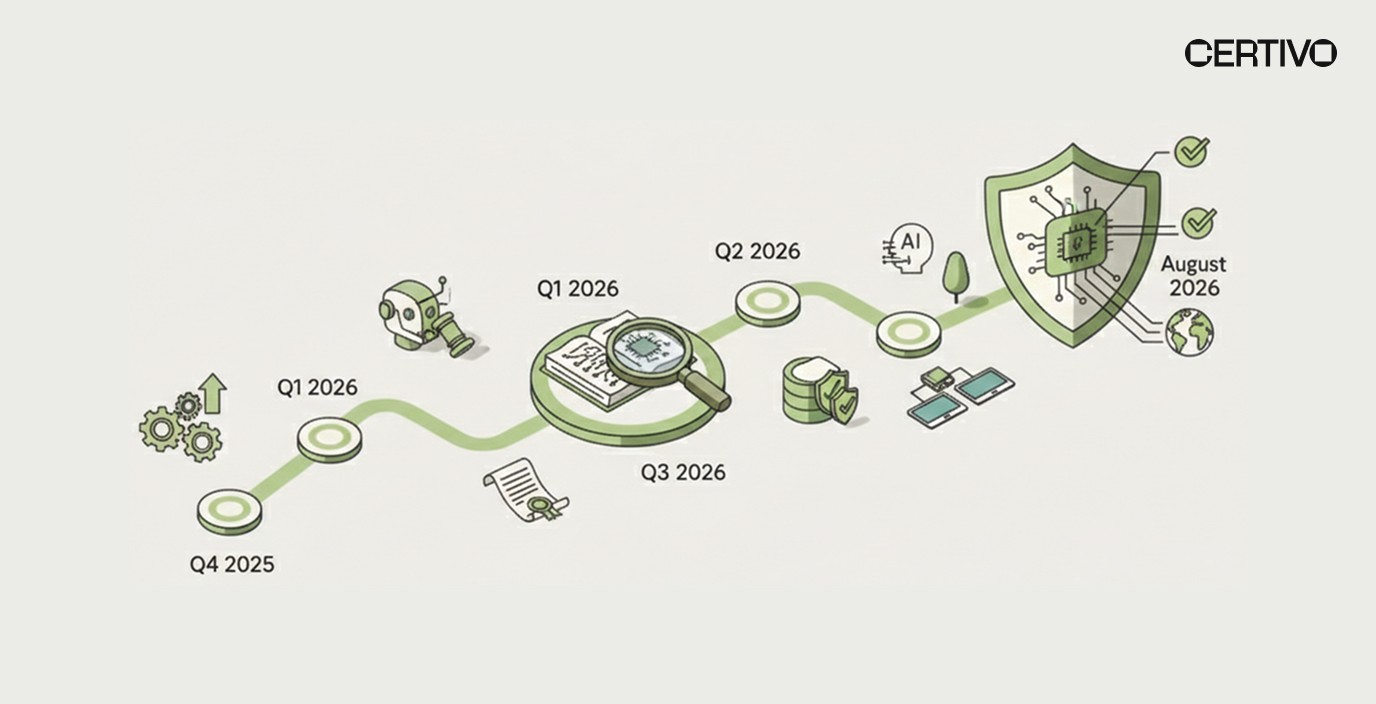

Timeline to August 2026: Strategic Preparation Roadmap

The period between now and August 6, 2026 provides limited time for comprehensive compliance preparation. Organizations should structure activities across defined phases to ensure readiness at enforcement commencement.

Phase 1: Assessment and Gap Identification (Immediate – Q2 2025)

Organizations should immediately assess product portfolios to identify items containing formaldehyde or formaldehyde-releasing substances. This assessment should extend to raw materials, components, and finished goods across all product lines intended for EU markets.

Gap identification activities include:

Product portfolio screening against formaldehyde content

Supplier material composition verification

Current emission testing capability assessment

Documentation system evaluation against REACH requirements

Resource requirement estimation for compliance achievement

Building future-ready compliance infrastructure during this phase establishes foundations for sustainable compliance rather than temporary fixes.

Phase 2: Remediation and Testing (Q3 2025 – Q1 2026)

Following gap identification, organizations should implement remediation activities including product reformulation, alternative material qualification, and testing program establishment. This phase requires significant cross-functional coordination across R&D, procurement, manufacturing, and quality functions.

Testing program establishment must address:

Laboratory selection and qualification

Testing methodology validation

Sample collection and handling procedures

Result interpretation and documentation

Non-conformance response protocols

Phase 3: Supply Chain Alignment (Q2 2026 – Q3 2026)

As the deadline approaches, organizations should ensure supply chain alignment with compliance requirements. Supplier certifications, material declarations, and compliance documentation must flow throughout supply chains to support compliance demonstration.

Compliance and regulation managers should coordinate supplier alignment activities to ensure consistent implementation across vendor networks.

Phase 4: Verification and Continuous Monitoring (August 2026 Onward)

Following enforcement commencement, organizations must maintain continuous compliance through ongoing monitoring, testing, and documentation activities. Automated regulatory monitoring systems ensure organizations detect and respond to compliance deviations before enforcement actions occur.

How AI Transforms REACH Compliance Management

Manual compliance approaches cannot scale to address the complexity of REACH Annex XVII formaldehyde compliance across extensive product portfolios and global supply chains. AI compliance software for chemicals fundamentally transforms organizational capabilities for regulatory monitoring, testing management, and documentation maintenance.

Intelligent Regulatory Monitoring

Regulatory landscapes affecting chemical compliance evolve continuously as ECHA updates guidance, member states clarify enforcement approaches, and testing methodologies advance. Automated regulatory monitoring capabilities track these developments across relevant jurisdictions, alerting compliance teams to changes requiring response.

Understanding why people-only compliance cannot scale helps executives appreciate the strategic value of AI-powered monitoring that operates continuously across regulatory domains without proportional staff increases.

Automated Product Screening

Product portfolios spanning thousands of items require systematic screening against regulatory requirements. AI platforms enable automated screening that identifies products requiring formaldehyde testing or reformulation within hours rather than weeks of manual review. This capability proves particularly valuable when new restrictions like the formaldehyde amendment affect multiple product categories simultaneously.

Supply Chain Compliance Automation

Supply chain compliance automation extends organizational visibility beyond internal operations to encompass supplier practices and material compositions. AI platforms automate supplier data collection, verify compliance certifications, and flag gaps requiring remediation. Effective supply chain collaboration becomes systematic rather than episodic.

Certivo's platform incorporates CORA, an intelligent assistant that automates supplier follow-ups and data completion workflows. Rather than manual email chasing, CORA systematically engages suppliers to collect required documentation, reducing administrative burden while improving data completeness.

Audit-Ready Documentation

Compliance documentation must demonstrate current practices aligned with REACH restricted substances compliance requirements. AI platforms maintain audit-ready documentation that evolves as regulations change, eliminating the scramble that typically precedes regulatory inspections or customer audits. Staying audit-ready across frameworks becomes systematic compliance practice.

Building Compliance Infrastructure for Formaldehyde Restrictions

Sustainable REACH Annex XVII formaldehyde compliance requires infrastructure investment extending beyond immediate regulatory response. Organizations building robust compliance capabilities position themselves to address not only the formaldehyde amendment but ongoing evolution of EU chemical restrictions.

Testing Program Infrastructure

Organizations should establish or access testing capabilities aligned with ECHA-recognized methodologies for formaldehyde emission measurement. This infrastructure may include:

Internal laboratory capabilities for screening tests

Qualified external laboratory relationships for certification testing

Sample collection and handling procedures

Result tracking and documentation systems

Non-conformance escalation protocols

Supplier Management Systems

Supplier compliance programs must address formaldehyde content in raw materials and components. Supplier management capabilities should include material declaration collection, compliance certification verification, and ongoing monitoring for supplier compliance status changes.

Documentation and Traceability

REACH compliance requires documentation demonstrating that products meeting emission limits throughout manufacturing and supply chain processes. Traceability systems must link finished products to material sources, testing results, and supplier certifications. Replacing spreadsheets with scalable systems enables this traceability at enterprise scale.

Cross-Framework Integration

Formaldehyde restrictions intersect with other regulatory frameworks including REACH SVHC requirements, indoor air quality standards, and product safety regulations. Integrated compliance platforms address multiple frameworks simultaneously, preventing fragmented approaches that increase costs and create compliance gaps.

The REACH framework page provides additional context on how Certivo supports comprehensive REACH compliance beyond formaldehyde-specific requirements.

Insert image after this section

Image Type: AI compliance platform dashboard showing REACH monitoring

Alt Text: AI compliance software for chemicals managing REACH formaldehyde restrictions

Conclusion: Strategic Imperatives for August 2026 Readiness

The REACH Annex XVII formaldehyde amendment represents a significant expansion of EU chemical restrictions affecting manufacturers across furniture, construction, textiles, automotive, and consumer goods sectors. The emission limits of 0.062 mg/m³ for furniture and wood-based articles and 0.080 mg/m³ for other articles establish demanding thresholds that require systematic compliance preparation before August 6, 2026.

Organizations maintaining REACH Annex XVII formaldehyde compliance must address product formulation, testing programs, supply chain verification, and documentation systems across potentially extensive product portfolios. The complexity of these requirements exceeds what manual processes can reliably manage, particularly for organizations with diverse product lines and global supplier networks.

The business consequences of non-compliance extend beyond regulatory penalties to include EU market exclusion, supply chain disruption, and reputational damage that affects customer relationships and investor confidence. Organizations recognizing these stakes are investing in AI compliance software for chemicals that automates regulatory monitoring, product screening, and documentation management.

The timeline to August 2026 provides limited opportunity for comprehensive compliance preparation. Organizations should begin assessment activities immediately, identifying products requiring attention and establishing remediation priorities. Those that delay face compressed timelines, elevated costs, and increased risk of missing the enforcement deadline.

Executive leadership must recognize that REACH restricted substances compliance represents ongoing operational reality rather than one-time project. Building robust compliance infrastructure today positions organizations to address not only the formaldehyde amendment but continuing evolution of EU chemical restrictions that will follow in subsequent regulatory cycles.

Schedule a consultation with Certivo to assess your organization's REACH Annex XVII formaldehyde compliance readiness and develop AI-powered strategies that ensure EU market access while reducing compliance operational burden.