Lavanya

Feb 3, 2026

Washington State has positioned itself at the forefront of American PFAS regulation with the Safer Products for Washington Act, and the January 1, 2027 sales ban creates immediate compliance obligations for manufacturers, importers, and distributors serving this market. The Cycle 1.5 amendments to Chapter 173-337 WAC establish strict prohibitions on intentionally added PFAS in apparel, cleaning products, and automotive washes, with a critical 50 ppm total fluorine enforcement threshold that shifts burden of proof to manufacturers.

Organizations without robust Washington State PFAS sales ban compliance programs face market exclusion, enforcement actions, and reputational damage as the deadline approaches. The regulation introduces a rebuttable presumption framework that requires manufacturers to maintain continuous audit-ready documentation proving PFAS absence when products exceed testing thresholds. Understanding these requirements now enables strategic preparation rather than reactive scrambling as regulatory change monitoring becomes essential for market access.

Table of Contents

Understanding the Safer Products for Washington Framework

Key Deadlines and Implementation Milestones

The 50 ppm Total Fluorine Presumption

Product Categories Affected by the 2027 Ban

Reporting Requirements and Notification Categories

Exemptions and Sell-Through Provisions

Business and Supply Chain Implications

Strategic Preparation Checklist

How AI Transforms PFAS Compliance Management

Understanding the Safer Products for Washington Framework

The Safer Products for Washington Act (RCW 70A.350) establishes Washington's comprehensive approach to reducing toxic chemicals in consumer products. The regulatory framework targets chemicals when safer alternatives are feasible and available, reflecting a precautionary approach that prioritizes public health and environmental protection over industry convenience.

The Washington Department of Ecology Safer Products program administers this framework through cyclical regulatory updates. Cycle 1.5 amendments specifically address PFAS, the class of per- and polyfluoroalkyl substances known as "forever chemicals" due to their extreme environmental persistence and documented health concerns.

Washington State PFAS sales ban compliance requires understanding that this regulation prohibits the manufacture, sale, and distribution of affected products containing intentionally added PFAS. The scope extends beyond direct manufacturers to include importers and distributors, creating compliance obligations throughout supply chains serving Washington markets. Organizations must establish multi-tier supply chain transparency to verify PFAS absence across sourcing networks.

The Department of Ecology developed these restrictions based on findings that safer alternatives exist for targeted product categories. This determination process means additional product categories may face future restrictions as alternative availability expands, making regulatory horizon scanning intelligence essential for long-term compliance planning.

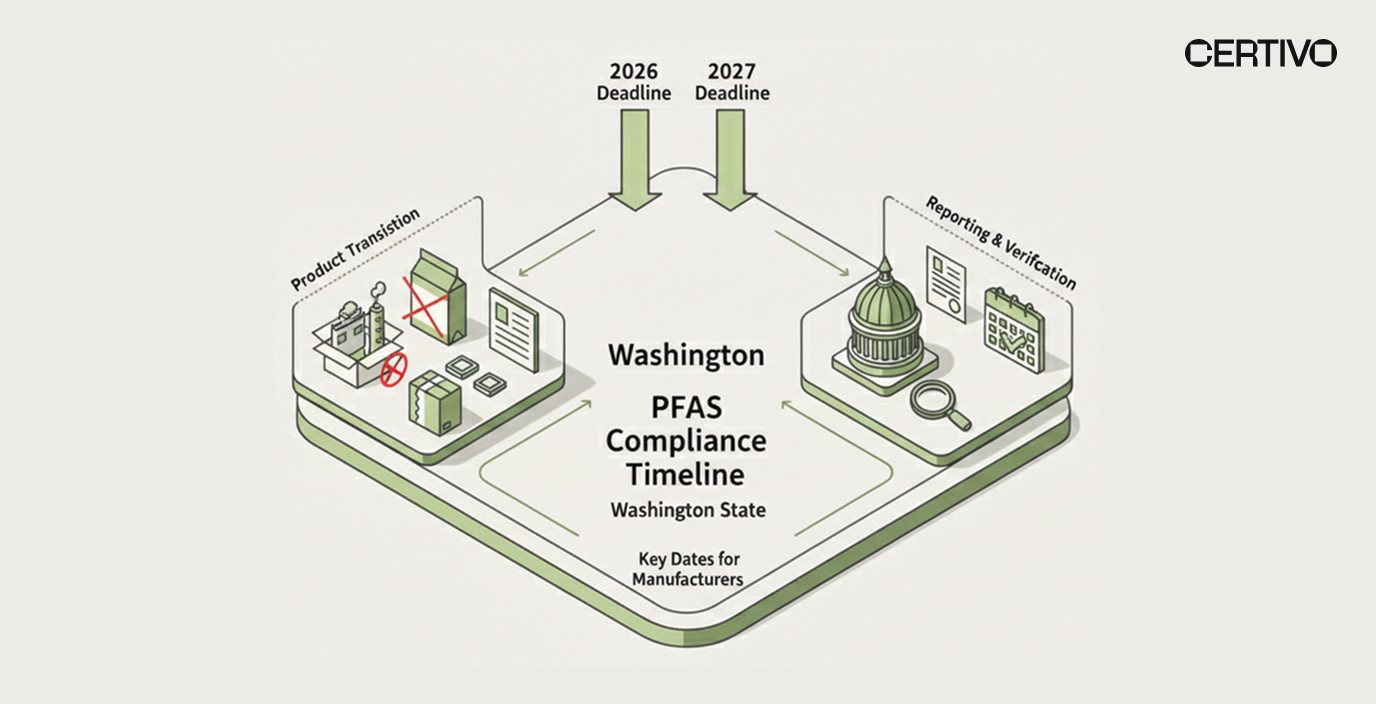

Key Deadlines and Implementation Milestones

The Safer Products for Washington PFAS restrictions follow a phased implementation schedule that organizations must track carefully. Multiple overlapping deadlines create compliance complexity requiring systematic monitoring and preparation.

Implementation Timeline Summary

Milestone | Date | Requirement |

|---|---|---|

PFAS Tracking Begins | January 1, 2026 | Manufacturers must begin tracking and identifying PFAS in products requiring reporting |

Sales Ban Effective | January 1, 2027 | Prohibition on manufacture, sale, and distribution of PFAS-containing apparel, cleaning products, and auto washes |

First Annual Reporting Due | January 31, 2027 | Reporting notifications due for nine product categories including cookware, footwear, and firefighting PPE |

January 1, 2026: Tracking Obligation Begins

This milestone is now live, requiring manufacturers to begin tracking and identifying PFAS in products subject to reporting requirements. Categories requiring tracking include footwear, cookware, ski wax, and other designated products. Organizations should have established tracking systems and supplier data collection processes by this date.

January 1, 2027: Sales Ban Takes Effect

The prohibition on intentionally added PFAS becomes enforceable for apparel, cleaning products, and automotive washes. Products manufactured before this date receive sell-through exemption, but new production must meet Washington State PFAS sales ban compliance requirements. Proactive compliance risk management enables organizations to prepare reformulation strategies before enforcement begins.

January 31, 2027: First Reporting Notifications Due

Manufacturers of products in nine additional categories must submit annual reporting notifications to the Department of Ecology. This reporting requirement creates continuous audit-ready documentation obligations that extend beyond the initial sales ban categories.

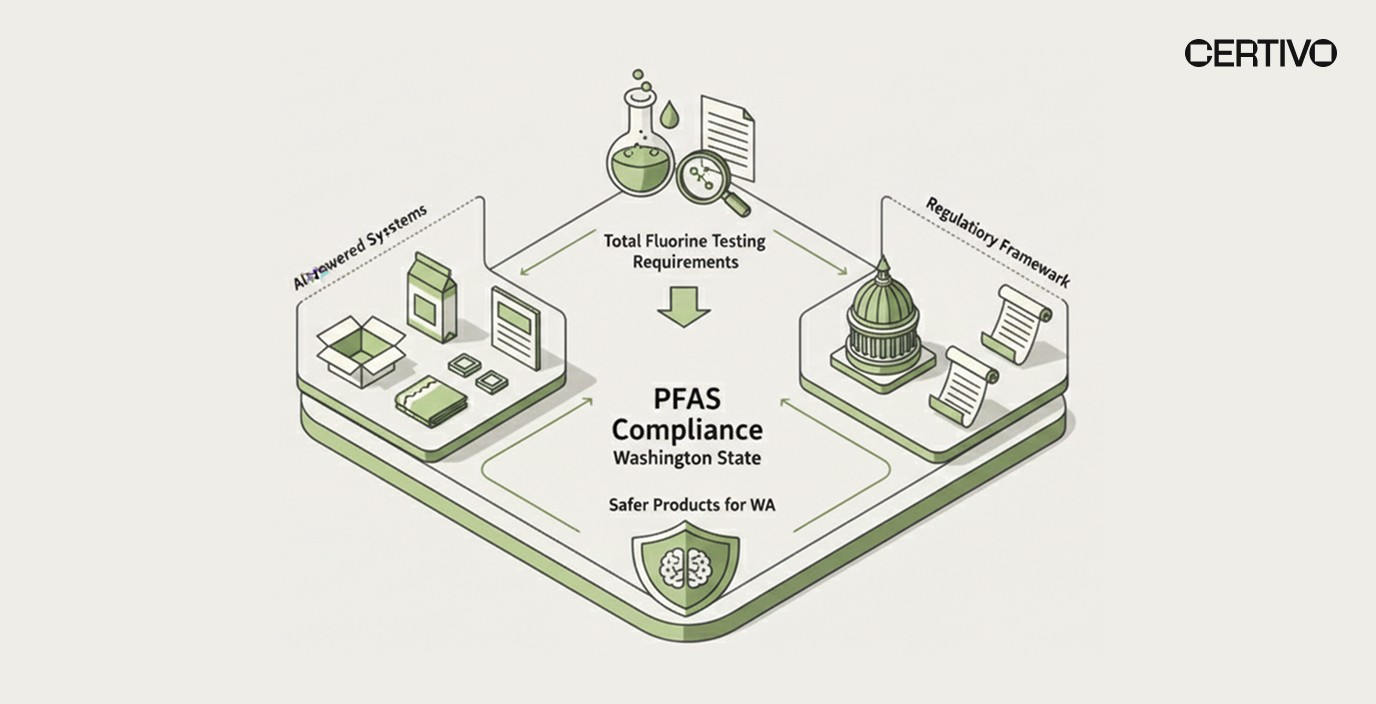

The 50 ppm Total Fluorine Presumption

Washington has introduced a critical enforcement mechanism that fundamentally changes how PFAS compliance requirements manufacturers face are evaluated. The 50 ppm total fluorine threshold creates a rebuttable presumption framework with significant implications for testing, documentation, and burden of proof.

How the Presumption Works

The Department of Ecology presumes the presence of intentionally added PFAS if a product tests above 50 parts per million (ppm) total fluorine. This presumption applies regardless of manufacturer intent or knowledge, creating strict liability exposure for products exceeding the threshold.

Burden of Proof Shifts to Manufacturers

When products exceed 50 ppm total fluorine, manufacturers must provide "credible evidence" demonstrating that fluorine does not derive from intentionally added PFAS. Acceptable evidence may include:

Documentation proving fluorine originates from contamination

Evidence demonstrating inorganic fluorine sources

Testing data distinguishing PFAS from other fluorine compounds

Supply chain documentation verifying PFAS-free formulations

This burden-shifting mechanism requires organizations to maintain comprehensive documentation systems capable of producing evidence on demand. Building future-ready compliance infrastructure becomes essential for managing total fluorine testing requirements effectively.

Testing and Documentation Requirements

Organizations must implement testing protocols capable of measuring total fluorine content and, when thresholds are exceeded, distinguishing PFAS from other fluorine sources. AI compliance software PFAS tracking capabilities enable systematic management of testing data across product portfolios and supplier networks.

Product Categories Affected by the 2027 Ban

The January 2027 sales ban specifically targets three high-priority consumer product categories where the Department of Ecology has determined safer alternatives are feasible and available. Understanding category scope enables accurate compliance assessment across product portfolios.

Apparel and Accessories

The apparel PFAS restrictions US markets now face under Washington law cover broad product categories including:

Clothing items of all types

Costumes and theatrical garments

Everyday accessories

Leather goods and products

Textile-based accessories

The regulation explicitly excludes "extreme use" gear from the sales ban, though such products remain subject to reporting requirements. This distinction requires careful product classification to determine applicable compliance obligations under Washington State PFAS sales ban compliance frameworks.

Cleaning Products

The cleaning products category encompasses household and commercial cleaning formulations where PFAS has historically provided surfactant and soil-release properties:

All-purpose cleaners

Bathroom cleaners

Dish soaps and detergents

Glass cleaners

Surface cleaning products

Manufacturers must reformulate products to eliminate intentionally added PFAS or exit the Washington market for affected categories. Compliance and regulation managers should coordinate reformulation timelines with R&D and procurement teams.

Automotive Washes

Vehicle cleaning products face specific targeting under Safer Products for Washington regulations:

Car wash soaps

Automotive detergents

Vehicle cleaning concentrates

Wash and wax formulations

The regulation includes a specific exemption for PFAS used as propellants in automotive washes, though this narrow exception does not extend to other PFAS applications in these products.

Reporting Requirements and Notification Categories

Beyond the sales ban categories, Washington State PFAS sales ban compliance includes mandatory reporting for nine additional product categories. These reporting obligations create ongoing documentation requirements that demand systematic tracking and automated regulatory monitoring capabilities.

Categories Requiring Annual Reporting

Manufacturers must submit annual notifications for the following product categories:

Cookware and food preparation items

Footwear products

Ski wax formulations

Firefighting personal protective equipment

Additional categories designated by the Department of Ecology

Reporting Content Requirements

Annual notifications due by January 31, 2027, must include comprehensive product and substance information enabling regulatory oversight. Organizations must establish data collection systems capable of generating required reports efficiently.

The reporting framework creates continuous audit-ready documentation obligations extending beyond point-in-time compliance verification. Streamlined supplier documentation processes ensure data flows throughout supply chains to support reporting requirements.

Exemptions and Sell-Through Provisions

The Safer Products for Washington regulations include specific exemptions that organizations may leverage where applicable. Understanding these provisions enables compliance strategies that maintain market access for legitimate use cases while minimizing transition disruption.

Sell-Through Exemption

Products manufactured before January 1, 2027, are exempt from the sales ban. This provision enables orderly market transition by allowing existing inventory to clear through distribution channels. Organizations must document manufacturing dates to claim this exemption and should forecast inventory clearance timelines accordingly.

The sell-through exemption does not apply to products manufactured after the effective date, even if using materials or components produced earlier. Procurement and supply chain leaders should coordinate manufacturing schedules to maximize compliant production before the deadline.

Propellant Exemption

PFAS used specifically as a propellant in automotive washes or cleaning products receives exemption from the sales ban restriction. This narrow exception recognizes technical limitations in propellant alternatives while maintaining restrictions on other PFAS applications within these product categories.

Organizations claiming this exemption must document that PFAS presence derives exclusively from propellant function rather than other product performance purposes. The burden of demonstrating exemption eligibility rests with manufacturers, requiring robust documentation systems.

Extreme Use Gear Exception

Apparel and accessories designated as "extreme use" gear are currently excluded from the sales ban, though they remain subject to reporting requirements. This exception recognizes that PFAS may currently be necessary for protective performance in specialized applications where alternatives are not yet feasible.

Business and Supply Chain Implications

Washington State PFAS sales ban compliance creates business consequences extending beyond direct regulatory obligations. Organizations must understand these implications to secure executive support for compliance investments and coordinate effectively across functional areas.

Market Access and Commercial Continuity

Products failing to meet compliance requirements face exclusion from Washington State markets. For manufacturers with significant Pacific Northwest distribution, non-compliance threatens commercial relationships and revenue streams that may be difficult to recover once lost.

Multi-tier supply chain transparency becomes essential for verifying PFAS absence across complex sourcing networks. Organizations cannot rely solely on supplier certifications without verification mechanisms that identify potential compliance gaps before products reach market.

Supply Chain Reconfiguration

Global supply chains may require reconfiguration to source PFAS-free materials and formulations. Suppliers unable or unwilling to meet Safer Products for Washington regulations requirements must be replaced, creating procurement challenges and potential supply disruptions during transition periods.

Effective supplier collaboration enables early identification of supplier capabilities and compliance gaps. Organizations engaging suppliers proactively gain transition time that reactive approaches forfeit.

Testing and Documentation Costs

The 50 ppm total fluorine presumption requires testing investments beyond standard product quality protocols. Organizations must budget for total fluorine testing requirements across product portfolios and maintain documentation systems capable of producing evidence on demand when thresholds are exceeded.

Competitive Positioning

Early compliance achievement creates competitive advantages as the January 2027 deadline approaches. Organizations demonstrating Washington State PFAS sales ban compliance can assure customers of continued supply while competitors struggle with reformulation delays. Responding faster to customer RFQs requires compliance documentation systems capable of producing current certifications efficiently.

Strategic Preparation Checklist

Organizations should implement systematic preparation activities to achieve and maintain Washington State PFAS sales ban compliance. The following checklist provides framework for compliance program development aligned with key deadlines.

Product Portfolio Assessment

Identify all products distributed in Washington State markets

Classify products against banned and reporting categories

Screen formulations for intentionally added PFAS

Evaluate supply chain materials for potential PFAS contamination

Prioritize products by revenue exposure and reformulation complexity

Testing Program Establishment

Identify qualified laboratories for total fluorine testing

Establish testing protocols aligned with 50 ppm threshold requirements

Develop sample collection and handling procedures

Create documentation systems for test results and evidence

Prepare rebuttal evidence procedures for threshold exceedances

Supplier Qualification and Data Collection

Survey suppliers regarding PFAS content and alternatives

Collect material declarations and compliance certifications

Qualify alternative suppliers where current sources cannot comply

Establish ongoing monitoring for supplier compliance status

Implement centralized supplier data management systems

Documentation and Reporting Readiness

Implement compliance documentation management systems

Establish manufacturing date tracking for sell-through claims

Create audit-ready record retention protocols

Develop enforcement response procedures

Prepare annual reporting submission workflows

VPs and directors of quality should coordinate these activities across functional areas to ensure comprehensive preparation.

How AI Transforms PFAS Compliance Management

Manual compliance approaches cannot scale to address the complexity of Washington State PFAS sales ban compliance across extensive product portfolios and global supply chains. AI compliance software PFAS tracking fundamentally transforms organizational capabilities for regulatory monitoring, testing management, and documentation maintenance.

Intelligent Regulatory Monitoring

PFAS regulatory landscapes evolve continuously across US states and international jurisdictions. Washington's restrictions represent one element of broader North American PFAS regulation. Automated regulatory monitoring chemicals capabilities track developments across relevant markets, alerting compliance teams to changes requiring response.

Understanding why people-only compliance cannot scale helps executives appreciate strategic value of AI-powered monitoring operating continuously across regulatory domains.

Automated Product Screening

Product portfolios spanning thousands of items require systematic screening against PFAS restrictions and reporting requirements. AI platforms enable automated screening that identifies products requiring testing or reformulation within hours rather than weeks of manual review.

Global PFAS regulations compliance guidance provides frameworks for comprehensive PFAS compliance across markets beyond Washington State.

Supply Chain Compliance Automation

Multi-tier supply chain transparency extends organizational visibility beyond internal operations to encompass supplier practices and material compositions. AI platforms automate supplier data collection, verify compliance certifications, and flag gaps requiring remediation.

Certivo's platform incorporates CORA, an intelligent assistant that automates supplier follow-ups and data completion workflows. Rather than manual email chasing, CORA systematically engages suppliers to collect required documentation, reducing administrative burden while improving data completeness for PFAS compliance requirements manufacturers must meet.

Continuous Audit-Ready Documentation

The 50 ppm total fluorine presumption requires organizations to produce evidence on demand when products exceed testing thresholds. AI platforms maintain continuous audit-ready documentation that evolves as regulations change and testing results accumulate. Staying audit-ready across frameworks becomes systematic compliance practice rather than episodic scramble.

Conclusion: Strategic Imperatives for Washington Market Access

Washington State PFAS sales ban compliance represents a significant regulatory milestone affecting manufacturers across apparel, cleaning products, and automotive care sectors. The January 2027 sales ban, combined with the 50 ppm total fluorine presumption and January 2026 tracking requirements, creates multi-layered compliance obligations that demand systematic preparation.

The regulatory framework's burden-shifting mechanism places responsibility on manufacturers to demonstrate PFAS absence when products exceed testing thresholds. This requirement elevates documentation capabilities from administrative convenience to regulatory necessity, making continuous audit-ready documentation essential for market access.

Organizations maintaining Washington State PFAS sales ban compliance must address product reformulation, testing programs, supply chain verification, and documentation systems across potentially extensive product portfolios. The complexity of managing compliance across multiple deadlines, testing thresholds, and reporting categories exceeds what manual processes can reliably manage.

The business consequences of non-compliance extend beyond regulatory penalties to include Washington market exclusion, supply chain disruption, and reputational damage affecting customer relationships and investor confidence. Organizations recognizing these stakes invest in AI compliance software PFAS tracking that automates regulatory monitoring, product screening, and documentation management.

Safer Products for Washington regulations signal regulatory trajectory that other US states and international jurisdictions will follow. Building robust PFAS compliance infrastructure today positions organizations to address not only Washington requirements but continuing evolution of PFAS restrictions across North American and global markets.

Explore how Certivo can support your compliance readiness and develop AI-powered strategies ensuring Washington State market access while reducing compliance operational burden.

Lavanya

Lavanya is an accomplished Product Compliance Engineer with over four years of expertise in global environmental and regulatory frameworks, including REACH, RoHS, Proposition 65, POPs, TSCA, PFAS, CMRT, FMD, and IMDS. A graduate in Chemical Engineering from the KLE Institute, she combines strong technical knowledge with practical compliance management skills across diverse and complex product portfolios.

She has extensive experience in product compliance engineering, ensuring that materials, components, and finished goods consistently meet evolving international regulatory requirements. Her expertise spans BOM analysis, material risk assessments, supplier declaration management, and test report validation to guarantee conformity. Lavanya also plays a key role in design-for-compliance initiatives, guiding engineering teams on regulatory considerations early in the product lifecycle to reduce risks and streamline market access.

Her contributions further extend to compliance documentation, certification readiness, and preparation of customer deliverables, ensuring transparency and accuracy for global stakeholders. She is adept at leveraging compliance tools and databases to efficiently track regulatory changes and implement proactive risk mitigation strategies.

Recognized for her attention to detail, regulatory foresight, and collaborative approach, Lavanya contributes significantly to maintaining product compliance, safeguarding brand integrity, and advancing sustainability goals within dynamic, globally integrated manufacturing environments.