Hari prasanth

Feb 11, 2026

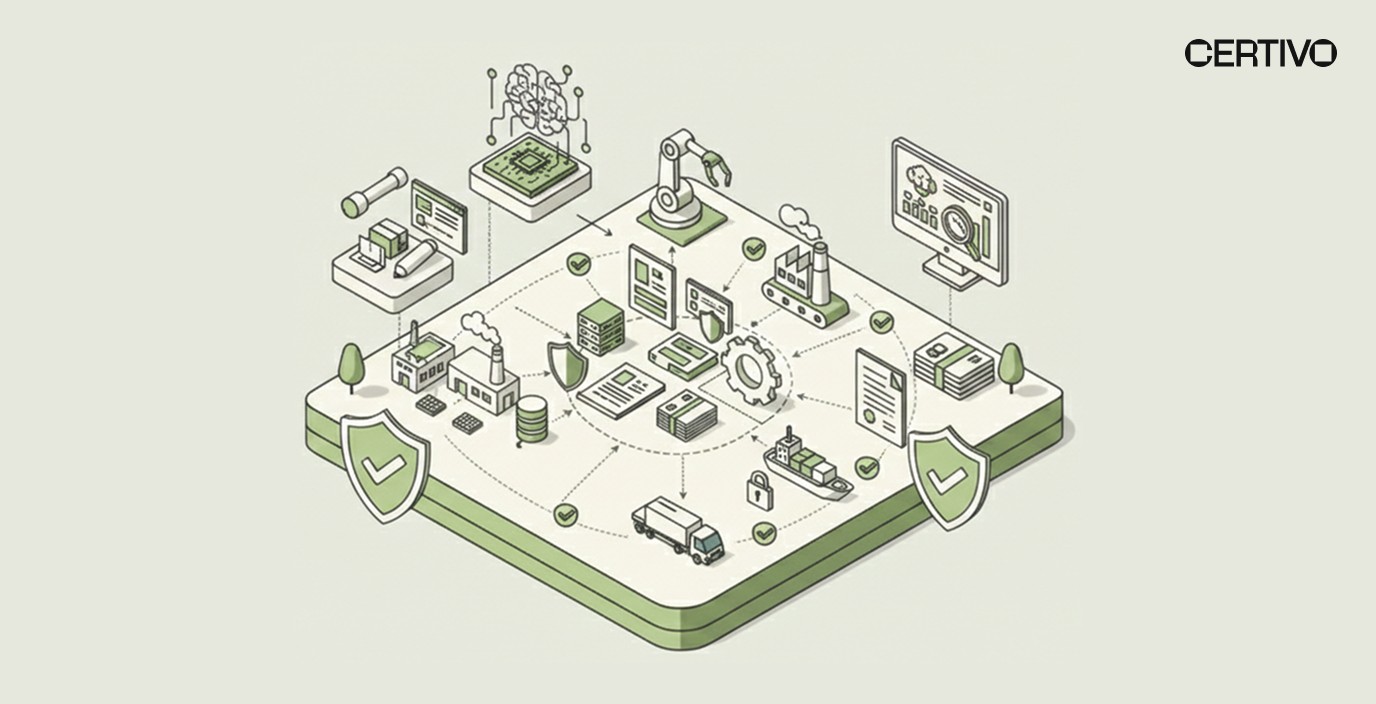

Product compliance has become a continuous operational requirement rather than a pre-launch verification step. Manufacturers operating across global markets face simultaneous regulatory obligations spanning chemical restrictions, material declarations, product safety standards, and environmental frameworks. These requirements apply not at the company level, but at the product level—and in many cases, at the bill of materials level.

A single product variant may trigger compliance obligations under REACH, RoHS, TSCA, California Proposition 65, state-level PFAS restrictions, and emerging digital product passport requirements. Traditional compliance workflows treat regulatory verification as a discrete phase between design finalization and commercial release. This approach assumes stable regulatory environments, predictable substance restrictions, and supplier data that remains current throughout a product's market lifecycle. None of these assumptions hold true in 2026.

Regulatory frameworks evolve continuously. Substance restrictions expand through candidate list additions, annex updates, and jurisdiction-specific bans. Supplier formulations change without notification. Manual compliance processes—spreadsheets, email-based supplier questionnaires, and disconnected documentation systems—cannot maintain compliance visibility as products move from design through production, market release, and ongoing commercial availability.

Enterprise organizations need tools that integrate compliance intelligence across the entire product lifecycle. This means connecting design engineering systems, supplier networks, production planning platforms, and regulatory monitoring capabilities into a unified compliance architecture. The question is not whether manufacturers need end-to-end product compliance tools, but which capabilities these tools must provide to support compliance at the speed and scale that global operations demand.

This article examines the technical and operational requirements for end-to-end product compliance, the specific capabilities manufacturers need at each product lifecycle stage, and how integrated compliance platforms transform disconnected regulatory processes into continuous market readiness.

Table of Contents

Why End-to-End Product Compliance Requires Integrated Tools

Design Phase: Embedding Compliance Intelligence in Product Development

Supplier Onboarding: Automating Material Data Collection and Validation

Production Planning: Maintaining Compliance Through Manufacturing Changes

Pre-Shipment Verification: Ensuring Market-Specific Regulatory Compliance

Post-Launch Monitoring: Continuous Compliance After Product Release

Documentation and Audit Readiness: Building Traceable Compliance Records

Integration Requirements: Connecting Compliance Tools to Enterprise Systems

AI-Powered Compliance Platforms: How Intelligence Automation Replaces Manual Processes

Strategic Requirements for Selecting End-to-End Compliance Tools

Conclusion: From Reactive Verification to Continuous Market Readiness

Frequently Asked Questions

Why End-to-End Product Compliance Requires Integrated Tools

End-to-end product compliance means maintaining regulatory conformity from initial design specifications through active commercial distribution. This requires visibility into three distinct operational layers: product composition at the bill of materials level, supplier material declarations across multi-tier supply chains, and regulatory requirements across all target markets.

Manual compliance processes cannot maintain synchronization across these layers as products evolve through development, production scale-up, supplier transitions, and market expansions. The fundamental challenge is timing. Regulatory frameworks operate on enforcement timelines that do not align with product development cycles.

A substance added to the REACH Candidate List creates immediate disclosure obligations for products already in distribution. A state-level PFAS restriction may ban a coating chemistry used in products currently in production. Manufacturers cannot wait until pre-launch compliance reviews to discover that a raw material violates a newly enacted restriction.

By that point, tooling investments are committed, supplier contracts are executed, and production schedules are finalized. Integrated compliance tools prevent these failures by embedding regulatory intelligence directly into product development workflows. Design engineers receive real-time feedback on whether proposed materials trigger restrictions in target markets.

Procurement teams see compliance risk scores when evaluating supplier proposals. Production planners identify regulatory conflicts before manufacturing orders are released. This integration transforms compliance from a verification checkpoint into a continuous design constraint that shapes product decisions from concept through commercial availability.

The Cost of Disconnected Compliance Processes

The alternative—disconnected compliance processes managed through spreadsheets, email threads, and periodic supplier surveys—creates systematic blind spots. Product development teams lack visibility into emerging restrictions. Supplier data grows stale between annual update requests. Production changes introduce non-compliant materials without triggering compliance reviews.

These gaps do not surface until regulatory audits, customer inquiries, or market access denials force retrospective investigations. For manufacturers managing complex product portfolios across multiple regulatory frameworks, these disconnected processes become unsustainable.

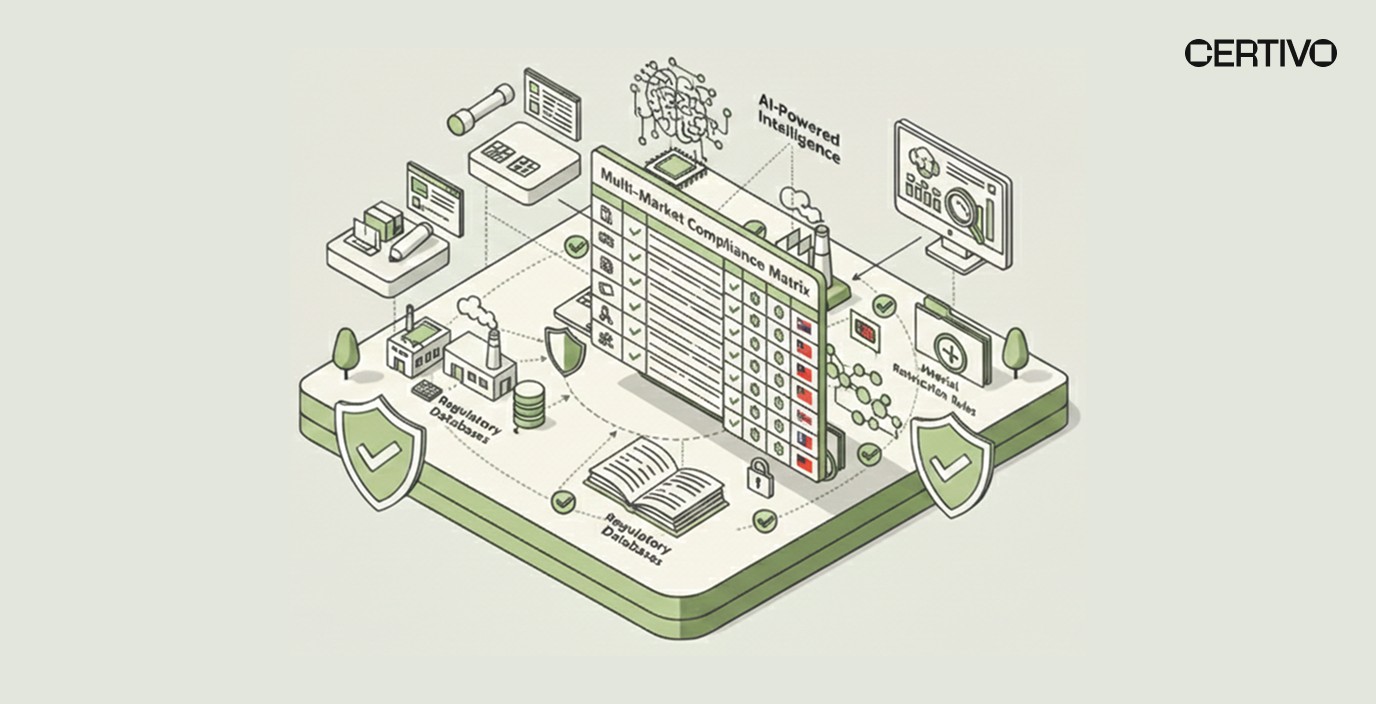

A company selling electronics into the EU, US, and Asian markets may face simultaneous obligations under REACH, RoHS, TSCA, California Proposition 65, and jurisdiction-specific chemical restrictions. Each framework defines scope differently, applies distinct thresholds, and requires unique documentation formats.

Building a Single System of Record

Integrated PLM ERP compliance architectures address this complexity by creating a single system of record for product composition, supplier declarations, and regulatory requirements. Design data flows directly from CAD systems into compliance platforms. Supplier material declarations populate automatically through standardized questionnaire frameworks.

Regulatory updates trigger automated reviews of affected products and materials. This integration eliminates manual data transfers, reduces compliance verification cycles, and provides continuous audit-ready documentation without requiring compliance teams to reconstruct product histories from disconnected sources.

The operational impact extends beyond regulatory verification. Integrated compliance tools reduce time-to-market by identifying regulatory conflicts during design rather than at pre-launch reviews. They minimize supply chain disruptions by flagging supplier formulation changes that introduce restricted substances.

They enable faster market expansions by automating compliance assessments for new jurisdictions. These capabilities transform compliance from a cost center that delays product launches into an operational enabler that supports market access strategies.

Design Phase: Embedding Compliance Intelligence in Product Development

Product compliance decisions made during design have exponentially greater impact than those made during production or pre-launch verification. Material selections, supplier choices, and component specifications established in early design phases determine a product's regulatory profile across its entire commercial lifecycle.

Once designs reach production engineering, changing materials to address compliance issues requires retooling, supplier renegotiation, and validation testing—processes that add months to development timelines and millions to product costs. BOM-level compliance intelligence embedded in design tools allows engineering teams to evaluate regulatory implications of material choices before designs are finalized.

When a design engineer specifies a flame retardant, coating chemistry, or polymer grade, the compliance platform immediately screens that material against applicable restrictions in target markets. This real-time feedback prevents non-compliant materials from entering product specifications. It eliminates the costly cycle of design → compliance review → redesign that characterizes traditional workflows.

Real-Time Regulatory Screening During Design

The technical requirement is direct integration between CAD/PLM systems and compliance databases. Design engineers should not need to switch between applications or submit manual compliance requests. Regulatory screening must occur within the design environment as a native function.

When an engineer selects a component from a supplier catalog, the system automatically checks whether that component contains substances restricted under REACH Annex XVII, RoHS, or state-level PFAS bans.

This capability depends on maintaining current substance data across thousands of regulatory frameworks. Manual processes cannot keep pace with regulatory updates. A substance added to California's Proposition 65 list must immediately trigger alerts for products containing that substance—not when compliance teams discover the update weeks later during quarterly reviews.

Regulatory horizon scanning intelligence automates this monitoring. When ECHA adds substances to the REACH Candidate List, the compliance platform automatically identifies affected products and notifies relevant stakeholders. Design teams receive these alerts during active development, when material substitutions are still feasible. Platforms like Certivo use CORA to continuously monitor regulatory developments and map substance restrictions to product compositions in real time.

Supplier Data Integration in Design Workflows

Design-phase compliance also requires visibility into supplier material declarations. A component may appear compliant based on generic material specifications, but actual formulations from specific suppliers may introduce restricted substances. Integrated tools connect design specifications to supplier-specific material data.

When procurement negotiates with multiple suppliers for the same component, the compliance platform shows which suppliers provide compliant formulations and which introduce regulatory risks. This visibility enables procurement teams to make sourcing decisions based on compliance profiles, not just cost and delivery terms.

Supplier Onboarding: Automating Material Data Collection and Validation

Supplier material declarations form the foundation of product compliance, yet most manufacturers struggle to collect, validate, and maintain current supplier data. Traditional approaches rely on email-based questionnaires sent annually or when onboarding new suppliers. Suppliers respond with varying levels of detail, in different formats, and often without supporting documentation.

Compliance teams spend weeks chasing incomplete responses, translating foreign-language documents, and manually entering data into internal systems. By the time supplier data is collected and validated, formulations may have changed, rendering the declarations outdated.

Centralized supplier self-service portals eliminate these inefficiencies by providing suppliers with direct access to submit and update material declarations. Suppliers log into a dedicated portal, complete standardized supplier questionnaire frameworks that align with industry standards like IPC-1752A, and upload supporting documentation such as safety data sheets, test reports, and third-party certifications.

Structured Data Collection and Validation

The platform validates supplier submissions automatically. If a supplier declares a substance concentration that exceeds regulatory thresholds, the system flags the issue and requests clarification before the declaration is accepted. If a supplier uploads a safety data sheet that conflicts with declared substance compositions, the platform identifies the discrepancy and prompts the supplier to resolve it.

This automated validation reduces compliance team workload by eliminating manual data quality checks. It also ensures that supplier declarations meet minimum quality standards before entering the system of record. For manufacturers managing hundreds or thousands of suppliers, this validation capability is essential.

Without automation, compliance teams cannot feasibly verify every supplier declaration manually. Multi-tier supply chain transparency extends this capability beyond direct suppliers to sub-tier suppliers and raw material sources.

Products contain components sourced from multiple tiers of the supply chain. A circuit board manufacturer may purchase components from direct suppliers who source materials from sub-tier suppliers who obtain raw chemicals from producers. Compliance obligations often require traceability to the chemical manufacturer level, particularly for conflict minerals, PFAS substances, and substances of very high concern.

Extending Compliance Visibility to Sub-Tier Suppliers

Traditional compliance processes cannot reach beyond direct suppliers effectively. Emails sent to direct suppliers with requests to cascade questionnaires to their suppliers result in low response rates and incomplete data. Integrated compliance platforms enable direct supplier relationships at every tier.

Sub-tier suppliers access the same self-service portal as direct suppliers, complete the same standardized questionnaires, and submit declarations directly into the system. This architecture eliminates the cascading questionnaire model and provides manufacturers with direct visibility into material compositions across the entire supply chain. Certivo's CORA processes these supplier submissions automatically, extracting substance data from unstructured documents and validating declarations against regulatory databases.

The operational benefit is significant. When a substance is added to a restricted list, manufacturers can immediately identify which sub-tier suppliers provide materials containing that substance, which direct suppliers incorporate those materials into components, and which products include those components. This visibility enables targeted supplier engagement and product-specific risk assessments.

Production Planning: Maintaining Compliance Through Manufacturing Changes

Production planning introduces compliance risks that are often invisible in design-phase reviews. Alternative suppliers, material substitutions, and process changes made during manufacturing scale-up can introduce non-compliant substances without triggering compliance reviews. These changes occur for valid operational reasons—cost reductions, capacity constraints, lead time improvements—but they alter product compositions in ways that affect regulatory status.

Integrated PLM ERP compliance systems prevent these issues by maintaining compliance visibility as products transition from design to production. When production planners propose supplier changes or material substitutions, the compliance platform automatically assesses regulatory implications.

If a proposed change introduces a restricted substance or affects a declaration threshold, the system alerts compliance teams before the change is implemented. This proactive screening prevents compliance failures that would otherwise surface during customer audits, regulatory inspections, or market access denials.

Change Management and Compliance Impact Analysis

The technical requirement is bi-directional integration between ERP systems and compliance platforms. Production change orders must trigger compliance reviews automatically. When a planner updates a bill of materials to reflect a new supplier or alternate material, the compliance system evaluates whether that change affects regulatory status across all applicable frameworks.

This evaluation considers market-specific requirements. A material substitution that maintains compliance for EU markets may introduce violations in California due to Proposition 65 warning requirements. The compliance platform identifies these jurisdiction-specific impacts and provides planners with clear guidance on which changes can proceed and which require additional review.

For manufacturers producing variants of the same product for different markets, this capability is critical. Medical device manufacturers often produce region-specific versions with different material compositions to meet market-specific restrictions. Production planning must maintain clear separation between variants to prevent cross-contamination of non-compliant materials.

Production-Level Documentation and Traceability

Production-phase compliance also requires lot-level traceability. For regulated industries, compliance documentation must link specific product units to supplier lot numbers, material certifications, and test results. This traceability enables manufacturers to respond to regulatory inquiries, customer audits, and potential recalls with precise documentation showing which materials were used in which products.

Manual traceability systems based on paper records or disconnected databases cannot provide this level of precision at scale. Integrated compliance platforms capture lot-level data automatically as production orders are executed. When a supplier ships materials, lot numbers from packing slips flow directly into the compliance system and link to production orders that consume those materials.

This automated traceability eliminates manual data entry, reduces documentation errors, and ensures that compliance records accurately reflect actual production. It also enables rapid response to regulatory inquiries. When a regulator requests documentation proving compliance for a specific product batch, manufacturers can generate complete material traceability reports directly from the compliance platform.

Pre-Shipment Verification: Ensuring Market-Specific Regulatory Compliance

Pre-shipment verification represents the final compliance checkpoint before products enter commerce. This phase requires confirming that products meet all regulatory requirements for their destination markets, that required documentation is complete and current, and that any market-specific labeling or packaging requirements are satisfied.

Traditional pre-shipment compliance checks rely on manual review processes. Compliance teams receive shipment manifests from logistics, cross-reference product SKUs against compliance records, verify that required declarations and certifications are on file, and approve shipments for release. This manual process creates bottlenecks during high-volume periods and introduces errors when compliance status is unclear or documentation is incomplete.

Automated pre-shipment verification eliminates these bottlenecks by integrating compliance platforms directly with logistics and warehouse management systems. When a shipment is prepared, the system automatically verifies compliance status for every product in that shipment against the requirements of the destination market.

Market-Specific Compliance Validation

If products are shipping to the EU, the system confirms that REACH registration requirements are met, SVHC disclosure thresholds are not exceeded, and RoHS compliance is documented. If shipping to California, the system verifies Proposition 65 compliance and confirms that required warning labels are applied where necessary.

If shipping to states with PFAS reporting requirements, the system checks whether notification obligations have been satisfied. This market-specific validation prevents shipment of non-compliant products and reduces risk of customs holds, regulatory penalties, or market access denials.

The system also generates required shipping documentation automatically. Declarations of conformity, material safety data sheets, test reports, and certifications are compiled into shipment-specific compliance packages without manual document assembly. This automation reduces shipping delays caused by missing or incomplete documentation.

Blocking Non-Compliant Shipments

For products that fail compliance verification, the system blocks shipment and alerts compliance teams to resolve issues before release. This blocking mechanism is critical for preventing compliance failures. Without automated controls, non-compliant products can ship due to miscommunication, outdated information, or manual oversights.

Integrated compliance platforms make pre-shipment blocking a system-enforced control. Products cannot ship to markets where compliance status is unverified or non-compliant. This capability requires integration with warehouse management and ERP systems to enforce holds at the operational level. Certivo maintains compliance status at the product-market level, enabling automated shipment verification decisions that protect manufacturers from inadvertent regulatory violations.

Some manufacturers implement this as a hard block—shipments cannot proceed until compliance is confirmed. Others use a soft block that flags compliance issues but allows authorized personnel to override holds when business circumstances require. The appropriate control design depends on risk tolerance, regulatory exposure, and operational requirements.

Post-Launch Monitoring: Continuous Compliance After Product Release

Compliance obligations do not end when products enter commerce. Regulatory frameworks evolve continuously. New substances are added to restricted lists. Thresholds change. Enforcement policies shift. Products that were compliant at launch may become non-compliant months or years later due to regulatory updates.

Continuous compliance monitoring after product release requires systems that track regulatory changes and automatically assess impacts on active products. When ECHA adds a substance to the REACH Candidate List, the compliance platform identifies all products containing that substance and determines whether new disclosure obligations apply.

When a state enacts a PFAS ban, the system flags affected products and alerts commercial teams that sales into that jurisdiction must cease by the effective date. This automated monitoring transforms compliance from a point-in-time verification into an ongoing operational capability.

Regulatory Change Monitoring and Impact Assessment

The technical requirement is regulatory horizon scanning intelligence that monitors regulatory developments across all markets where products are sold. This includes official regulatory publications, draft regulations under development, enforcement guidance updates, and industry-specific compliance requirements.

For global manufacturers, this monitoring scope spans dozens of regulatory authorities, hundreds of frameworks, and thousands of individual substance restrictions. Manual monitoring is infeasible at this scale. Integrated compliance platforms automate regulatory monitoring by connecting to authoritative regulatory data sources and applying natural language processing to identify relevant updates.

When a relevant regulatory change is detected, the platform performs automated impact analysis. It identifies which products contain affected substances, calculates whether new thresholds are exceeded, determines which markets are impacted, and generates prioritized action lists for compliance teams. This automation compresses regulatory response cycles from weeks to days. Certivo's CORA continuously monitors regulatory publications from EPA, ECHA, and other authoritative sources, automatically translating regulatory changes into product-level compliance assessments.

For manufacturers with large product portfolios, automated impact analysis is essential. A single regulatory update may affect hundreds of products across multiple product lines. Manually reviewing each product to assess impact is time-prohibitive. Automated analysis provides compliance teams with focused lists of affected products, enabling targeted remediation efforts.

Customer Communication and Regulatory Notifications

Post-launch compliance also includes customer communication obligations. When products become non-compliant due to regulatory changes, customers must be notified. When REACH SVHC disclosure thresholds are exceeded due to candidate list additions, downstream customers must receive updated declarations.

Integrated compliance platforms automate these notifications by generating customer-specific compliance alerts and distributing them through established communication channels. This automation ensures timely notifications and provides audit trails demonstrating that disclosure obligations were satisfied.

The platform also manages regulatory notifications required when products exceed reporting thresholds or when banned substances are discovered in products. For example, TSCA Section 8(a)(7) PFAS reporting requires manufacturers to submit data when PFAS-containing products exceed specified thresholds. The compliance platform tracks cumulative volumes and triggers notification workflows when thresholds are approached.

Documentation and Audit Readiness: Building Traceable Compliance Records

Regulatory compliance requires defensible documentation demonstrating that products meet applicable requirements. This documentation must be complete, current, organized, and readily accessible during regulatory audits, customer assessments, and internal quality reviews. Manual documentation systems—file servers, shared drives, email archives—cannot provide this level of organization and accessibility at enterprise scale.

Continuous audit-ready documentation requires integrated compliance platforms that automatically capture, organize, and maintain all compliance-related records as products move through their lifecycle. When a supplier submits a material declaration, the platform stores it with version history, associates it with affected products, and makes it searchable by product, supplier, substance, or regulatory framework.

When a regulatory assessment is completed, the compliance determination is documented with supporting evidence, reviewer identity, assessment date, and applicable regulatory context. When a shipment is released, the platform captures the compliance verification decision, the specific requirements that were verified, and the documentation that supported the verification.

Structured Compliance Records and Audit Trails

This comprehensive documentation provides complete audit trails showing how compliance decisions were made, what information was available at the time, who made the decisions, and what supporting evidence existed. During regulatory audits, manufacturers can generate compliance reports showing complete documentation for specific products, time periods, or regulatory frameworks without manual file assembly.

The operational benefit is significant. Regulatory audits that previously required weeks of preparation—gathering documents from multiple systems, reconstructing decision history, verifying completeness—now require days. The compliance platform contains all necessary documentation in organized, searchable format with clear linkages between products, suppliers, materials, and regulatory requirements.

For manufacturers operating under quality management systems like ISO 9001 or medical device regulations, this audit readiness capability is essential. Quality audits require demonstrating that compliance processes are followed consistently, that documentation is complete, and that non-conformances are identified and corrected. Integrated compliance platforms provide this documentation automatically as a byproduct of normal operations.

Version Control and Historical Reconstruction

Documentation systems must also maintain version control across regulatory changes, supplier updates, and product modifications. When a supplier updates a material declaration, both the current version and historical versions must be retained with clear timestamps. When a product specification changes, the compliance platform must document what changed, when it changed, who approved it, and what compliance implications resulted.

This version control enables historical reconstruction. If a regulatory inquiry asks about product compositions from three years ago, manufacturers must demonstrate what materials were used at that time, what supplier declarations were on file, and what compliance assessments were performed. Integrated compliance platforms maintain complete historical records enabling precise responses to these inquiries.

The alternative—reconstructing historical compliance status from archived emails, spreadsheet versions, and supplier correspondence—is time-intensive, error-prone, and often incomplete. When compliance teams cannot definitively answer regulatory inquiries about historical products, they face increased scrutiny, potential penalties, and reputational risks.

Integration Requirements: Connecting Compliance Tools to Enterprise Systems

End-to-end product compliance requires deep integration between compliance platforms and existing enterprise systems. Compliance cannot function as a standalone application. It must connect to the systems where product data originates, where manufacturing decisions are made, where supplier relationships are managed, and where commercial transactions occur.

Integrated PLM ERP compliance architectures connect compliance platforms to product lifecycle management systems, enterprise resource planning systems, supplier relationship management systems, quality management systems, and customer relationship management systems. These integrations enable bidirectional data flow that keeps compliance information synchronized with operational reality.

PLM Integration for Design-Phase Compliance

PLM integration allows compliance platforms to access product structures, bill of materials, component specifications, and design documentation. When engineers modify designs, these changes flow automatically to the compliance platform triggering regulatory re-assessment. When compliance teams identify regulatory issues, remediation actions flow back to PLM as change requests integrated into normal engineering workflows.

This bidirectional integration eliminates manual data transfers between systems. Design changes do not require compliance teams to manually update product structures in separate compliance databases. Compliance issues do not require engineers to manually transcribe requirements from compliance reports into design specifications. Integration maintains data consistency and reduces administrative overhead.

ERP Integration for Production and Logistics

ERP integration provides compliance platforms with visibility into production orders, material purchases, supplier transactions, inventory movements, and shipment planning. When production planners modify bills of materials or substitute suppliers, the compliance platform assesses regulatory impacts automatically. When shipments are prepared, compliance verification occurs as part of normal logistics workflows.

ERP integration also enables cost allocation for compliance activities. When supplier questionnaires generate costs, these costs are captured in ERP systems and allocated to specific products, programs, or business units. This cost visibility supports business case development for compliance investments and enables ROI analysis for compliance automation initiatives.

Supplier Portal Integration

Supplier portal integration connects compliance platforms to supplier self-service systems where material declarations, certifications, and test reports are submitted. This integration eliminates email-based supplier communication and manual data entry. Suppliers submit information directly into structured formats that populate compliance databases automatically.

Portal integration also enables supplier performance tracking. The compliance platform monitors supplier response rates, declaration quality, documentation completeness, and update frequency. This data supports supplier risk scoring that identifies high-risk suppliers requiring additional oversight or qualification requirements.

API-First Architecture for Flexibility

Modern compliance platforms implement API-first architectures that support flexible integration with diverse enterprise systems. Rather than requiring custom integration projects for each system connection, API-first platforms expose standard interfaces that enterprise integration teams can connect to existing systems using common integration patterns.

This architecture reduces implementation timelines and ongoing maintenance requirements. When manufacturers upgrade ERP systems or adopt new PLM platforms, compliance integrations continue functioning through standardized APIs rather than requiring complete re-implementation. Certivo's API-first architecture enables seamless integration with major enterprise systems while CORA maintains compliance intelligence across all connected data sources.

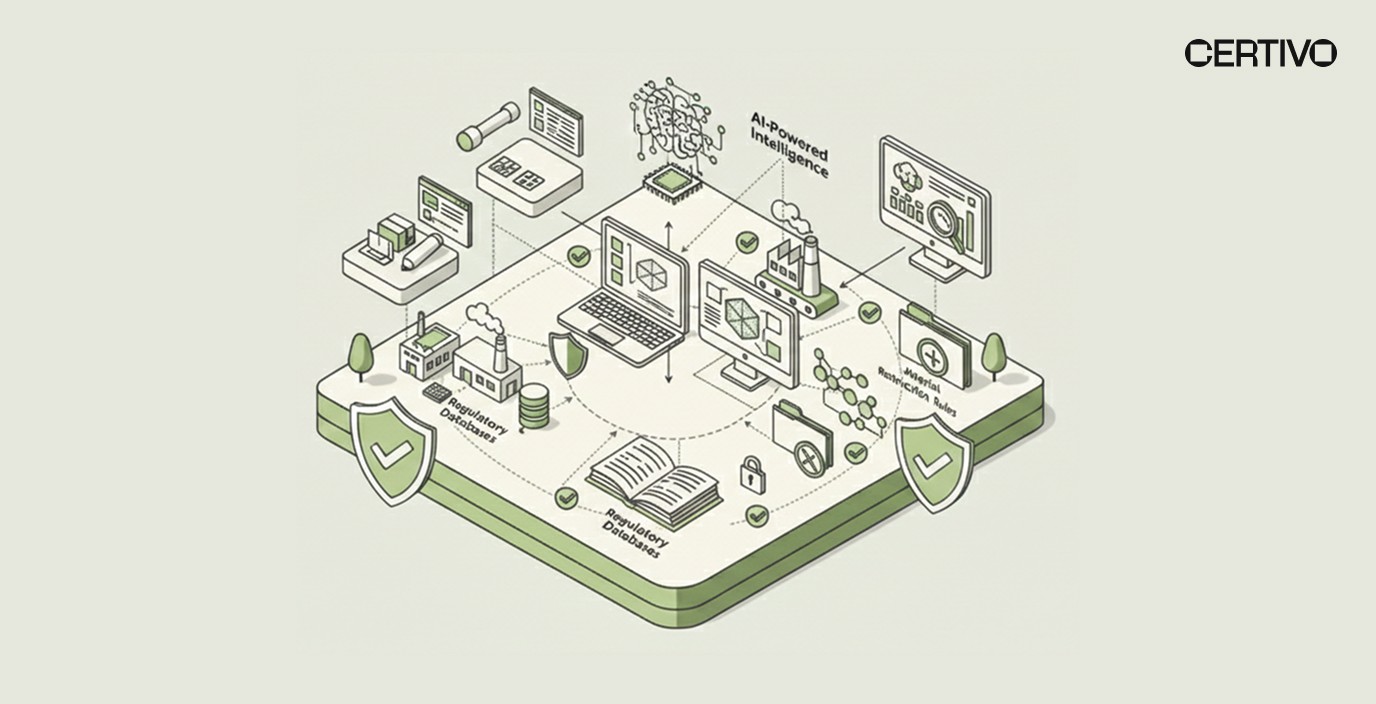

AI-Powered Compliance Platforms: How Intelligence Automation Replaces Manual Processes

AI-native compliance automation transforms how manufacturers manage regulatory obligations by replacing manual processes with intelligence capabilities that operate continuously at scale. Traditional compliance tools provide databases and workflow management but require humans to interpret documents, identify substances, assess regulatory applicability, and make compliance determinations.

AI-powered platforms automate these cognitive tasks using natural language processing, computer vision, and machine learning. When suppliers submit material declarations in unstructured formats—PDF documents, scanned images, foreign languages—the platform extracts substance data automatically, maps substances to regulatory frameworks, and generates compliance assessments without manual intervention.

Automated Document Processing and Substance Extraction

This automation begins with document ingestion. Suppliers submit safety data sheets, test reports, material declarations, and certifications in dozens of formats and languages. Manual processing requires compliance engineers to read each document, identify substance names and CAS numbers, extract concentration ranges, and manually enter data into compliance systems.

AI-powered platforms process these documents automatically. Computer vision extracts text from scanned images and low-quality PDFs. Natural language processing identifies substance names, concentrations, and regulatory identifiers even when presented in non-standard formats or foreign languages. Specialized substance reporting solutions map extracted substances to authoritative regulatory databases resolving synonyms, trade names, and CAS number variations.

This automated extraction reduces document processing time from hours to minutes per document. For manufacturers managing thousands of supplier documents annually, this efficiency gain eliminates processing backlogs and enables real-time supplier onboarding without manual bottlenecks. Certivo's CORA processes supplier documents in multiple formats and languages, automatically extracting substance data and validating it against regulatory substance lists maintained by EPA and ECHA.

Regulatory Intelligence and Automated Compliance Assessment

Beyond document processing, AI platforms provide regulatory horizon scanning intelligence that monitors regulatory developments and assesses impacts automatically. When ECHA publishes updates to REACH annexes, the platform identifies relevant changes, extracts affected substances and thresholds, updates internal regulatory databases, and triggers impact analysis across affected products.

This automated monitoring and assessment eliminates the manual process of regulatory tracking where compliance engineers subscribe to regulatory publications, read updates manually, interpret applicability, and manually review products for impacts. AI-powered compliance platforms perform these tasks continuously across hundreds of regulatory frameworks simultaneously.

The platform also generates automated compliance assessments by applying regulatory logic to product compositions. When a product contains a substance restricted under multiple frameworks, the platform evaluates applicable thresholds, exemption categories, use restrictions, and disclosure requirements across all relevant jurisdictions. It identifies conflicts where compliance with one framework creates violations under another and recommends resolution strategies. CORA performs these multi-framework assessments automatically, identifying compliance gaps and recommending remediation actions based on product compositions and target markets.

Continuous Learning and Accuracy Improvement

AI-powered platforms improve accuracy over time through continuous learning. When compliance engineers review automated assessments and make corrections, the platform learns from these corrections and applies improved logic to future assessments. When new regulatory patterns emerge—such as jurisdiction-specific interpretations of common requirements—the platform identifies these patterns and incorporates them into assessment logic.

This continuous improvement transforms compliance platforms from static rule engines into adaptive intelligence systems that become more accurate and capable as they process more data. For enterprise manufacturers, this adaptive capability is essential. Regulatory complexity exceeds what can be captured in static rule sets. Effective compliance requires systems that learn and adapt to new regulatory patterns.

Strategic Requirements for Selecting End-to-End Compliance Tools

Selecting compliance tools requires evaluating capabilities across multiple dimensions. The most critical requirement is comprehensive lifecycle coverage. The platform must support compliance activities from design through post-launch monitoring without requiring multiple disconnected systems. Products move continuously through lifecycle phases. Compliance tools must maintain continuous visibility across phase transitions.

Second, the platform must provide true multi-framework compliance management. Manufacturers face obligations under dozens of regulatory frameworks simultaneously. Tools that specialize in single frameworks—REACH-only tools, RoHS-only tools—create integration challenges and force manufacturers to maintain multiple systems. Comprehensive platforms manage all applicable frameworks within unified workflows.

Integration Capabilities and Enterprise System Compatibility

Third, integration capabilities must support connection to existing enterprise systems without requiring extensive custom development. Platforms with pre-built integrations to major PLM and ERP systems reduce implementation timelines and ongoing maintenance requirements. API-first architectures provide flexibility for connecting to proprietary or less common enterprise systems.

Fourth, the platform must support multi-tier supply chain transparency by providing supplier self-service capabilities and enabling direct data collection from sub-tier suppliers. Tools that rely solely on cascading questionnaires through direct suppliers cannot achieve the supply chain visibility modern compliance frameworks require.

Audit Readiness and Documentation Capabilities

Fifth, documentation and audit readiness capabilities must provide comprehensive compliance record-keeping without manual document assembly. During regulatory audits, manufacturers must produce complete documentation rapidly. Platforms that require manual document gathering from multiple systems create audit preparation burdens and increase audit risk when documentation is incomplete.

Sixth, regulatory monitoring and impact analysis must be automated and continuous. Manual regulatory monitoring cannot keep pace with global regulatory developments. Platforms must provide regulatory horizon scanning across all markets where products are sold and automated impact analysis when regulatory changes affect active products.

AI Capabilities and Automation Depth

Seventh, AI and automation capabilities must extend beyond workflow automation to include intelligent document processing, automated compliance assessment, and continuous learning. Rule-based platforms require constant manual rule updates as regulations evolve. AI-powered platforms adapt automatically to new regulatory patterns and improve accuracy over time.

Finally, the platform must provide executive visibility into compliance status, risk exposure, and program performance. Board members and senior executives need compliance dashboards showing portfolio-wide compliance status, regulatory risk exposure by market and product line, and operational metrics demonstrating compliance program effectiveness. Compliance tools designed for compliance engineers alone do not provide the executive visibility modern governance requires.

Conclusion: From Reactive Verification to Continuous Market Readiness

End-to-end product compliance requires integrated tools that connect design, production, and post-launch operations into unified compliance workflows. Manual processes based on spreadsheets, email questionnaires, and disconnected systems cannot maintain compliance visibility as products evolve through their lifecycle and as regulatory frameworks continue expanding in scope and complexity.

Manufacturers must transition from reactive compliance verification performed at pre-launch checkpoints to continuous compliance monitoring that identifies regulatory issues when they emerge and maintains continuous audit-ready documentation throughout product lifecycles. This transition requires integrated platforms that embed compliance intelligence into operational workflows where product decisions are made.

The technical foundation is integrated PLM ERP compliance architecture that connects compliance platforms to design systems, production planning, supplier networks, and logistics operations. These integrations eliminate manual data transfers, reduce compliance verification cycles, and ensure that compliance information remains synchronized with operational reality.

The operational foundation is AI-native compliance automation that replaces manual document processing, regulatory monitoring, and compliance assessment with intelligent capabilities that operate continuously at scale. These AI capabilities transform compliance from a manual verification activity into an automated intelligence function that supports faster product launches, reduces market access risks, and enables confident expansion into new markets.

For manufacturers evaluating compliance tools, the selection criteria must prioritize comprehensive lifecycle coverage, multi-framework management, deep enterprise integration, multi-tier supply chain support, automated regulatory monitoring, AI-powered automation, and executive visibility. Platforms that meet these requirements transform compliance from an operational constraint into a strategic enabler that supports faster product launches, confident market expansion, and reduced regulatory risk exposure.

Organizations ready to transform compliance operations from reactive verification to continuous market readiness should explore how platforms like Certivo support integrated compliance management across product lifecycles and regulatory frameworks.

Frequently Asked Questions

How can companies reduce compliance-related delays in product launches?

Companies reduce compliance-related delays by embedding BOM-level compliance intelligence directly into product design and development workflows. When regulatory checks occur as materials are selected, risks are identified before designs are finalized. Certivo enables this by connecting design data with regulatory requirements, allowing CORA to surface compliance issues early and prevent costly redesign cycles that delay launches.

How can companies maintain continuous compliance after product launch?

Continuous compliance requires ongoing monitoring of regulatory changes and their impact on active products. Certivo applies regulatory horizon scanning to continuously assess updates across global frameworks. CORA automatically identifies affected products, documents required actions, and supports timely updates to maintain compliance throughout the product lifecycle.

How can compliance data be shared securely with customers and regulators?

Secure data sharing is achieved through controlled access to product-specific compliance documentation. Certivo enables manufacturers to generate declarations and reports directly from the system of record, ensuring accuracy and consistency. All disclosures are logged with full audit trails, supporting regulatory accountability while protecting confidential information.

What integration capabilities should compliance platforms provide?

Effective compliance platforms integrate with PLM, ERP, supplier portals, and quality systems to ensure data consistency across operations. Certivo supports integrated PLM ERP compliance through standardized data connections. CORA helps maintain alignment between design, production, and compliance records as products and suppliers change.

What role does AI play in modern compliance management?

AI supports compliance by automating manual data processing and regulatory assessments at scale. Within Certivo, CORA processes unstructured supplier documents, maps substances to regulatory frameworks, and evaluates compliance continuously. This enables organizations to maintain audit-ready documentation without expanding compliance teams.