Lavanya

Feb 18, 2026

On 4 February 2026, the European Commission officially proposed the listing of bis(2-ethylhexyl) tetrabromophthalate — commonly known as TBPH — as a Persistent Organic Pollutant (POP) under the Stockholm Convention. This TBPH POP listing marks the beginning of a global phase-out process for one of the most widely used brominated flame retardants in plastics, automotive, electronics, and construction applications.

For compliance directors, product engineers, and executive teams across manufacturing sectors, this is not a distant regulatory signal. It is the start of a structured elimination pathway that will reshape material choices, supplier requirements, and market access strategies worldwide. Organizations that have not yet mapped TBPH presence across their product portfolios should begin proactive compliance risk management immediately.

This regulatory update covers every material detail from the European Commission's proposal: what TBPH is, why it has been nominated, which industries are affected, the compliance timeline, and how manufacturers should prepare for what comes next.

📌 Table of Contents

What Is TBPH and Why Is It Being Targeted?

What Changed: The EU's Stockholm Convention Nomination

Key Chemical Identity and Listing Criteria

Industries and Products Affected

Timeline: From Nomination to Global Ban

The Parallel REACH Restriction Track

Compliance Risks and Enforcement Implications

Operational and Supply Chain Impact

Compliance Readiness Checklist

The Role of AI in POPs Compliance Monitoring

Executive Conclusion

FAQs

What Is TBPH and Why Is It Being Targeted?

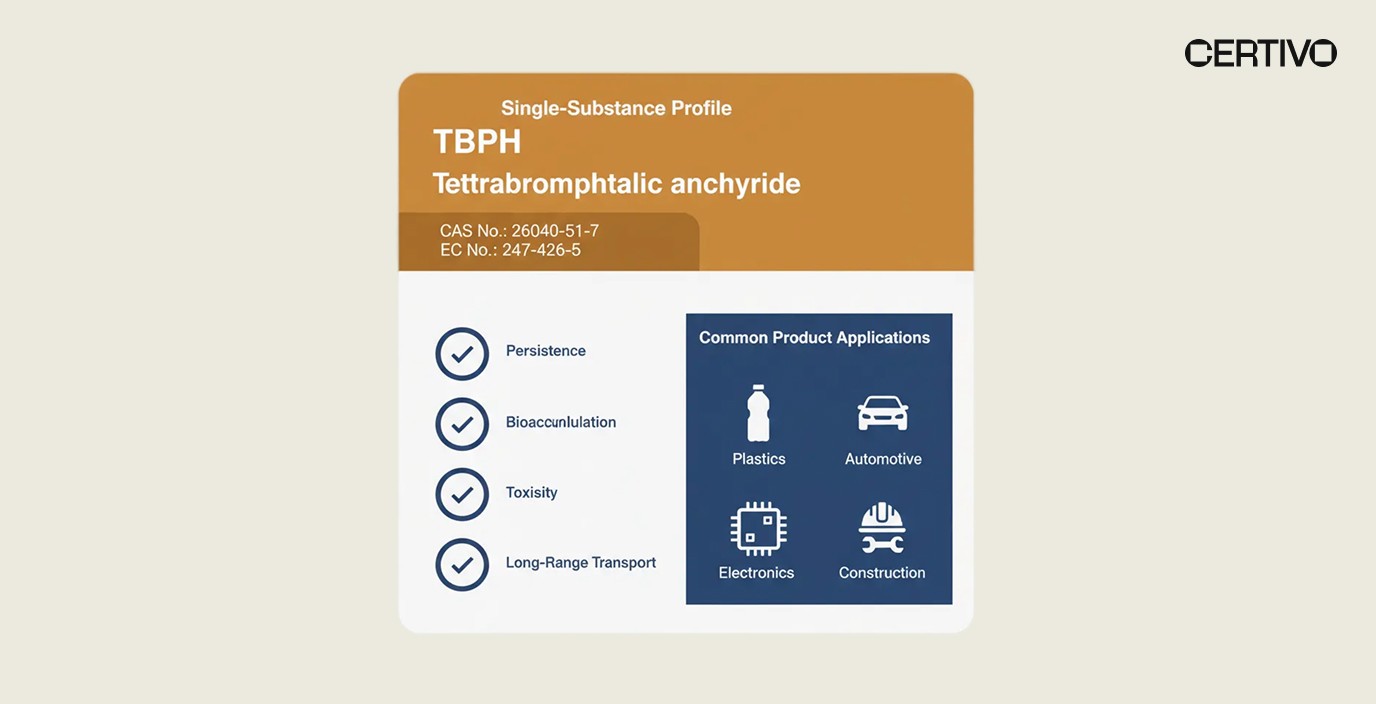

TBPH — bis(2-ethylhexyl) tetrabromophthalate — is a brominated flame retardant (BFR) and plasticizer used extensively across multiple manufacturing sectors. It is commonly found in commercial flame-retardant blends such as "Firemaster 550" and is added to materials to meet fire safety standards. For manufacturers navigating the broader landscape of persistent chemical restrictions, this development sits alongside existing EU POPs limits and digital product passport requirements.

The EU has identified TBPH as meeting all four criteria for classification as a Persistent Organic Pollutant:

High persistence: TBPH does not break down readily in the environment

Bioaccumulation: It accumulates in living organisms through the food chain

Toxicity: It poses risks to human health and ecosystems

Long-range environmental transport: TBPH has been detected in remote Arctic regions, far from any point of manufacture or use

These characteristics mean TBPH does not stay where it is used. It migrates through air, water, and biological systems — making it a global environmental and health concern regardless of where it is manufactured or applied. Organizations already managing POPs obligations should review proactive compliance strategies for POPs regulations to understand how this new listing fits within their existing framework.

What Changed: The EU's Stockholm Convention Nomination

The Stockholm Convention on Persistent Organic Pollutants is a global treaty — ratified by over 180 countries — that targets the elimination or restriction of the world's most dangerous chemical substances. Substances are listed under Annex A (Elimination) or Annex B (Restriction). The POPs regulatory framework directly affects product compliance obligations for every manufacturer selling into regulated markets.

On 4 February 2026, the European Commission submitted a formal proposal — COM(2026) 51 — to nominate TBPH for listing under the Convention. This is the first step in a structured multi-year process that, if successful, will result in a global ban on the manufacture, use, and trade of TBPH and TBPH-containing articles.

⚠ Why the EU is acting now:

The EU's stated objective is to align its internal REACH restrictions with international law and prevent "regulatory leakage." Without a global listing, TBPH-containing products manufactured in countries without domestic restrictions could still enter EU and other regulated markets — undermining the effectiveness of regional bans. Organizations managing cross-border compliance should understand how expanding into new markets will be affected by this nomination.

This nomination does not immediately ban TBPH. But it triggers a formal international review process and sends a clear signal to global manufacturers: the substance is on a path toward elimination. Companies that begin substitution planning now will have a significant competitive and compliance advantage. CEOs and founders should factor this into long-term product strategy decisions.

Key Chemical Identity and Listing Criteria

📊 Substance identification:

Field | Detail |

|---|---|

Chemical Name | bis(2-ethylhexyl) tetrabromophthalate (TBPH) |

EC Number | 247-426-5 |

CAS Number | 26040-51-7 |

Substance Type | Brominated flame retardant (BFR) / plasticizer |

Commercial Name | Found in "Firemaster 550" and similar blends |

Reason for Listing | High persistence, bioaccumulation, toxicity, long-range environmental transport |

Convention Annex | Proposed for Annex A (Elimination) or Annex B (Restriction) |

Manufacturers must be able to identify TBPH by both its CAS number and its presence within commercial blends. TBPH is not always listed by name on supplier material declarations — it may appear as a component of proprietary flame-retardant formulations. The ability to track compliance at the BOM level is essential for identifying hidden TBPH exposure in complex product assemblies.

✓ Critical identification note: TBPH is often co-formulated with other substances in commercial flame-retardant blends. Compliance teams must look beyond single-substance declarations and request full formulation disclosure from suppliers. Streamlining supplier documentation workflows ensures that substance-level data is captured accurately across the supply chain.

Industries and Products Affected

TBPH's widespread use as both a flame retardant and plasticizer means its potential removal affects a broad range of manufacturing sectors and product categories. For a comprehensive view of how chemical compliance obligations are evolving across sectors, see the ultimate guide to compliance management in 2026.

Industry | Affected Products / Applications |

|---|---|

Plastics & Polymers | Flexible PVC, polyurethane foams, wire and cable insulation |

Automotive | Seat upholstery, interior trim, engine compartment components |

Electronics | Printed circuit board components, electrical housings |

Construction | Carpet backing, wall coverings, sealants, roofing membranes |

Consumer Goods | Juvenile products (baby mats, car seats), furniture, adhesives |

⚠ High-risk product categories:

The presence of TBPH in juvenile products — baby mats, car seats, and children's furniture — is likely to attract particular regulatory and public scrutiny. Consumer safety expectations in these categories are higher than in industrial applications, and enforcement actions are more visible. Organizations in the automotive sector should assess interior trim and seating components as priority areas for TBPH screening.

For electronics manufacturers, TBPH in printed circuit board components and electrical housings presents a dual compliance challenge — particularly where products must also comply with RoHS restrictions. Companies in the semiconductor and PCB industry and industrial electronics should evaluate flame-retardant formulations across their component supply chains.

For construction materials companies, TBPH in sealants, carpet backing, and roofing membranes may also intersect with emerging PFAS restrictions in the same product categories. Organizations in construction and building materials must coordinate POPs phase-out planning with broader chemical compliance strategies.

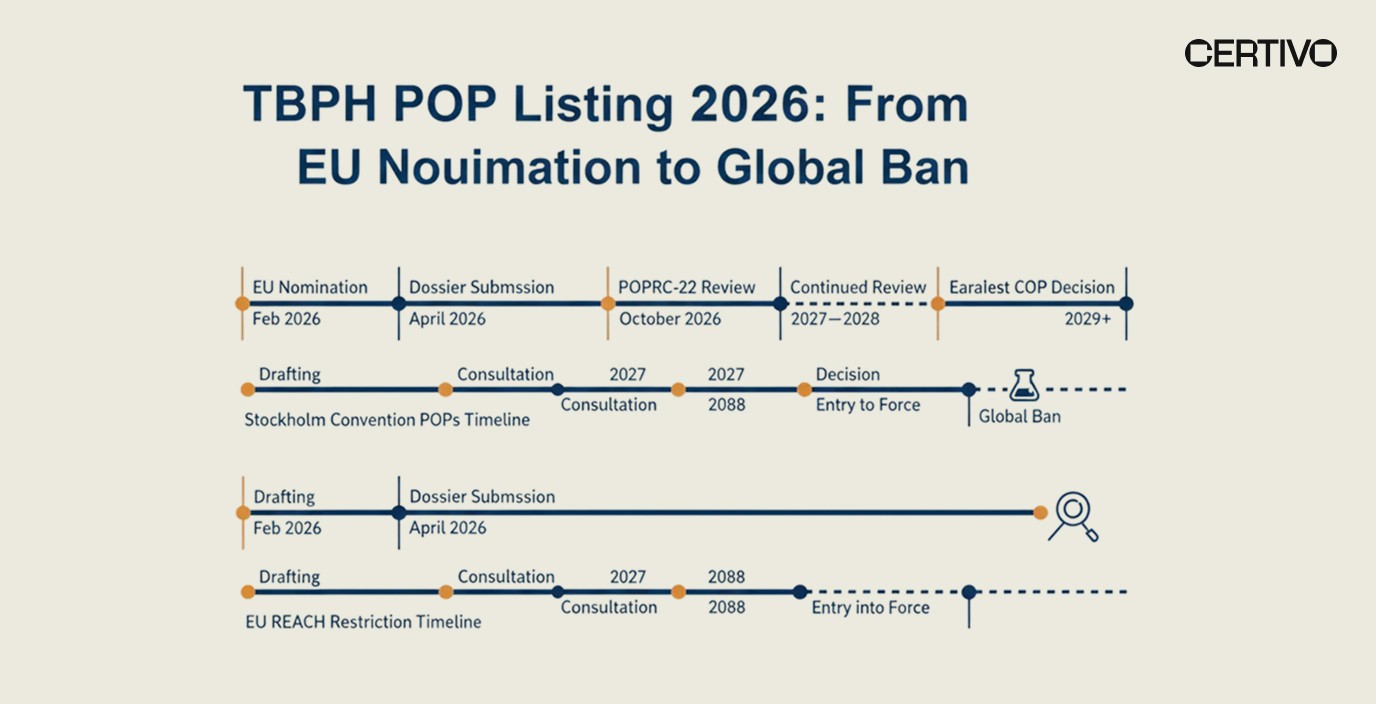

Timeline: From Nomination to Global Ban

The Stockholm Convention listing process follows a structured, multi-year pathway. While the final global ban is several years away, each milestone triggers increasing compliance expectations. Compliance and regulation managers should map these dates into their planning cycles now.

📊 Key milestones:

Date | Milestone | Implication |

|---|---|---|

4 February 2026 | EU formally proposes TBPH for Stockholm Convention listing | Nomination signals global phase-out intent |

April 2026 | Official dossier submitted to Stockholm Convention Secretariat | Formal international review process begins |

October 2026 | First review by POPs Review Committee (POPRC-22) | Scientific and risk assessment review |

2027–2028 | Continued POPRC review, risk management evaluation | Exemptions and transition periods debated |

2029 (Earliest) | Final decision by Conference of the Parties (COP) | Global ban or restriction adopted |

⚠ Do not wait for 2029. The nomination itself will trigger market and supply chain responses well before any formal ban takes effect. Large OEMs and brand owners are likely to issue supplier requirements for TBPH-free materials within 12–18 months of the nomination. Organizations that understand market readiness vs. risk exposure will act ahead of formal enforcement.

The Parallel REACH Restriction Track

The Stockholm Convention nomination is not the only regulatory action affecting TBPH. The EU is simultaneously advancing a REACH restriction that would prohibit the manufacture, placing on market, and use of TBPH within the European Economic Area. For manufacturers already managing REACH obligations, this intersects directly with existing REACH framework requirements.

This dual-track approach means:

EU manufacturers and importers will face binding restrictions under REACH before the global Stockholm Convention ban takes effect

Non-EU manufacturers exporting to the EU must comply with REACH restrictions on TBPH regardless of their domestic regulations

Global manufacturers selling into multiple jurisdictions must track both the Convention timeline and regional REACH enforcement

The EU's strategy is deliberate: by advancing REACH restrictions in parallel, it prevents TBPH-containing products from entering the EU market during the multi-year Convention review process. Organizations managing multi-framework compliance should explore how to stay audit-ready across frameworks simultaneously.

📌 Substitution guidance from the EU:

The European Commission encourages manufacturers to transition to halogen-free flame-retardant alternatives, including:

Aluminum trihydroxide (ATH) — mineral-based, widely available

Ammonium polyphosphate (APP) — effective in polyurethane and textile applications

Manufacturers should evaluate these alternatives against their specific fire safety, mechanical performance, and cost requirements. Early substitution also positions companies favorably for emerging PFAS and chemicals risk management requirements, as many halogen-free alternatives also avoid PFAS-related compliance risks.

Compliance Risks and Enforcement Implications

While the global ban is years away, compliance risks begin accumulating from the moment of nomination. VPs and Directors of Quality should assess exposure across product lines immediately.

Immediate risks:

⚠ Customer requirements: Major OEMs and brand owners routinely require suppliers to eliminate substances under active regulatory review — often years before formal bans

⚠ Tender disqualification: Products containing nominated POPs may be excluded from public procurement and ESG-screened tenders

⚠ Reputational risk: TBPH in juvenile products (baby mats, car seats) presents particularly high brand and liability exposure

Future enforcement risks (once listed):

⚠ Import bans: Products containing TBPH above threshold limits will be prohibited from entering regulated markets

⚠ Penalties under EU POPs Regulation (EU) 2019/1021: Fines and market withdrawal for non-compliant products

⚠ Supply chain disruption: Suppliers that have not reformulated will become compliance liabilities

The compliance burden extends beyond the substance itself. Organizations must document their TBPH status — whether present, absent, or below threshold — across all products and supply chain inputs. Understanding why ESG failure is a supply chain risk, not just a reporting issue is essential context for this kind of chemical phase-out.

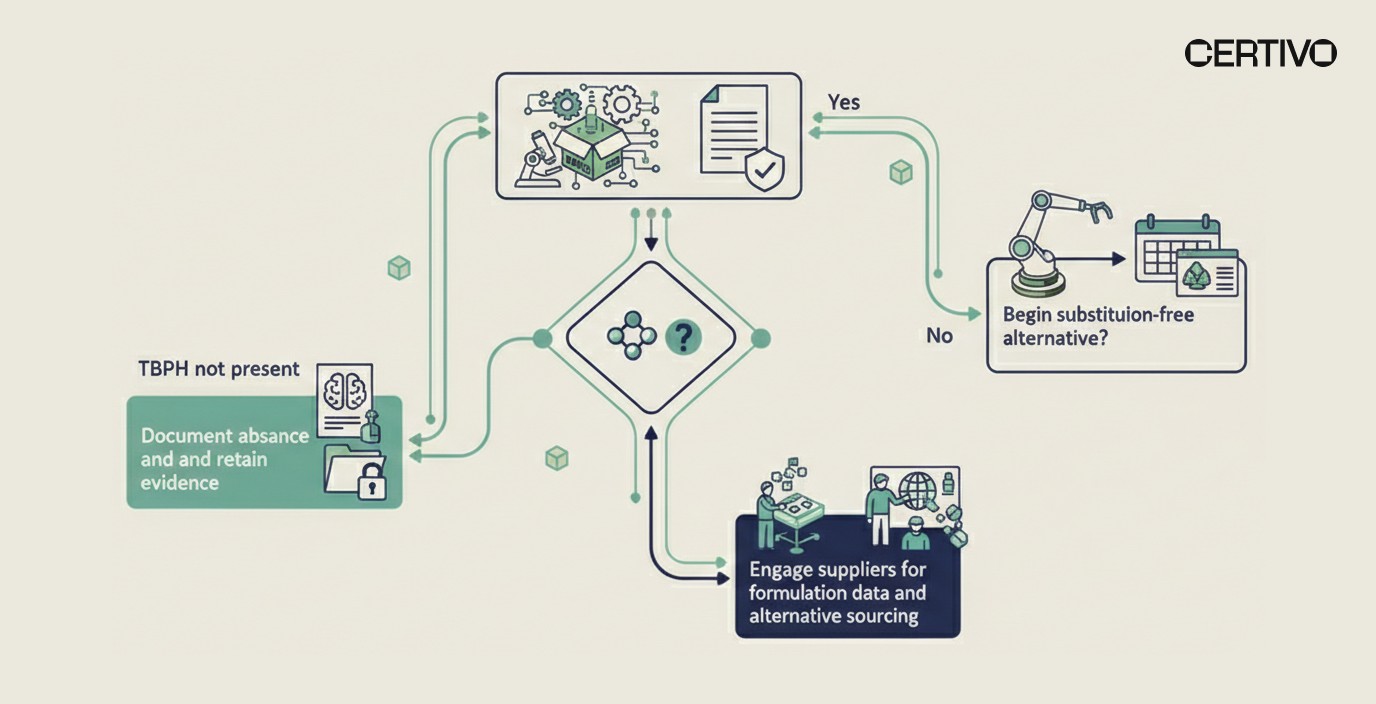

Operational and Supply Chain Impact

The TBPH nomination creates several operational imperatives that require cross-functional coordination between compliance, procurement, engineering, and quality teams. VP of Operations should ensure these actions are resourced and tracked.

For all affected manufacturers:

✓ Identify all products and components containing TBPH or TBPH-containing flame-retardant blends (e.g., Firemaster 550)

✓ Issue substance disclosure requests to all suppliers in affected product categories

✓ Evaluate halogen-free flame-retardant alternatives for each application

✓ Document substitution timelines and communicate to customers

For supply chain and procurement teams:

✓ Map tier-1 and tier-2 suppliers using TBPH-containing formulations

✓ Request full formulation disclosure for all flame-retardant blends — not just top-level substance names

✓ Prioritize suppliers that have already transitioned to halogen-free alternatives

Supply chain data gaps represent the most common operational bottleneck. TBPH may be present in commercial blends under proprietary names that do not reference the substance directly. Collaborating with suppliers through structured data collection workflows is essential for accurate substance identification.

For organizations managing product portfolios across multiple regions, the TBPH phase-out must be coordinated with other chemical restrictions including REACH SVHC obligations and state-level PFAS requirements. The ability to standardize compliance across plants and regions reduces duplication and ensures consistent substance management globally. Procurement and supply chain leaders are on the frontline of this transition.

Compliance Readiness Checklist

📌 Use this checklist to assess your organization's preparedness for the TBPH phase-out:

# | Action Item | Status |

|---|---|---|

1 | Screen all products and BOMs for TBPH (CAS 26040-51-7) and TBPH-containing blends | ☐ |

2 | Issue supplier substance disclosure requests covering brominated flame retardants | ☐ |

3 | Request full formulation data for commercial blends (e.g., Firemaster 550) | ☐ |

4 | Evaluate halogen-free alternatives (ATH, APP) for each affected application | ☐ |

5 | Document current TBPH usage volumes and product applications | ☐ |

6 | Establish substitution timelines for each affected product line | ☐ |

7 | Update restricted substance lists (RSLs) to include TBPH | ☐ |

8 | Communicate TBPH phase-out plans to key customers and OEMs | ☐ |

9 | Monitor Stockholm Convention review milestones (POPRC-22, COP) | ☐ |

10 | Monitor parallel EU REACH restriction progress | ☐ |

For organizations still relying on manual tracking for chemical compliance, this is an opportunity to evaluate replacing spreadsheets with a scalable compliance system. Teams managing multiple chemical phase-outs simultaneously benefit from building a future-ready compliance infrastructure that can track substances, timelines, and supplier responses in a single system of record.

The Role of AI in POPs Compliance Monitoring

Chemical phase-outs like the TBPH nomination demand capabilities that exceed what manual compliance processes can reliably deliver — particularly when the substance is hidden inside proprietary commercial blends across multi-tier supply chains. For a detailed look at how AI transforms chemical compliance workflows, see a compliance engineer's week with and without AI.

The operational demands include:

Substance identification across thousands of BOMs, where TBPH may appear under proprietary blend names

Supplier data collection at scale, requesting formulation-level disclosure from hundreds of suppliers

Alternative evaluation comparing halogen-free substitutes against performance, cost, and regulatory criteria

Multi-framework tracking coordinating Stockholm Convention milestones with REACH restrictions, PFAS requirements, and customer RSLs

AI-native compliance platforms address these challenges by:

✓ Scanning BOM and material composition data to flag TBPH presence at the component level

✓ Automating supplier substance disclosure requests and tracking response rates

✓ Cross-referencing commercial blend names against known TBPH-containing formulations

✓ Providing regulatory horizon scanning to track Convention review milestones and REACH restriction progress

✓ Generating audit-ready documentation that maps substance status across all affected products

For organizations managing TBPH alongside other chemical restrictions, AI tools for compliance management provide a comprehensive overview of platform capabilities. IT and systems leaders play a critical role in evaluating and deploying these solutions.

Companies managing multiple simultaneous chemical phase-outs — TBPH, PFAS, SVHC candidates — benefit from AI-powered supply chain compliance management that consolidates substance tracking, supplier communication, and regulatory monitoring into a single platform. Understanding how to save time on compliance management with AI is particularly relevant when managing overlapping chemical deadlines.

Executive Conclusion

The European Commission's proposal to list TBPH under the Stockholm Convention signals the beginning of a structured global elimination process for this widely used brominated flame retardant. While the final TBPH POP listing and global ban may not take effect until 2029 at the earliest, the compliance, supply chain, and market access implications begin now.

Manufacturers across plastics, automotive, electronics, construction, and consumer goods sectors must act decisively: identify TBPH exposure in product portfolios and supply chains, engage suppliers for formulation-level substance data, evaluate halogen-free alternatives, and document substitution timelines. The parallel EU REACH restriction track means that European market access will be affected well before the global Convention decision. For a broader perspective on managing chemical phase-outs alongside other regulatory obligations, review the global PFAS reckoning and how to prepare for bans and substitution requirements.

📌 The official European Commission proposal is available at COM(2026) 51 on the European Commission website. Organizations should also monitor updates from the Stockholm Convention Secretariat.

Organizations managing complex product portfolios, multi-tier supply chains, and overlapping chemical restrictions need compliance infrastructure that scales with regulatory complexity. To explore how AI-driven compliance platforms like Certivo support continuous regulatory readiness, connect with the Certivo team.

Frequently Asked Questions (FAQs)

Q1: Is TBPH banned globally right now?

No. The EU has proposed TBPH for listing under the Stockholm Convention, but the formal review process takes several years. The earliest a global ban could be adopted is 2029, following review by the POPs Review Committee and a final decision by the Conference of the Parties. However, the EU is advancing a parallel REACH restriction that will affect EU market access sooner. Review the POPs framework requirements for current obligations.

Q2: How do I identify TBPH in my products?

TBPH has CAS number 26040-51-7 and EC number 247-426-5. It is commonly found in commercial flame-retardant blends such as "Firemaster 550." Request full formulation disclosure from suppliers — not just top-level substance names. The ability to track compliance by BOM enables identification at the component level.

Q3: What are the recommended alternatives to TBPH?

The EU recommends halogen-free flame-retardant alternatives including aluminum trihydroxide (ATH) and ammonium polyphosphate (APP). Manufacturers should evaluate alternatives against fire safety performance, mechanical properties, cost, and regulatory status in their target markets. See how product compliance teams can launch new products faster while managing material transitions.

Q4: Does this affect products already on the market?

The nomination does not immediately restrict products currently on the market. However, once either the REACH restriction or the Stockholm Convention listing is finalized, products containing TBPH above threshold limits will be prohibited from sale in regulated markets. Companies should begin substitution planning now to avoid future market disruptions. For broader context on evolving chemical restrictions, see the REACH SVHC and Annex XVII changes.

Q5: Which industries are most affected by the TBPH phase-out?

Plastics and polymers, automotive, electronics, construction, and consumer goods manufacturers are all directly affected — particularly those using TBPH in flexible PVC, polyurethane foams, wire insulation, printed circuit boards, and juvenile products. Companies in the automotive industry and aerospace and defense sectors should prioritize TBPH screening in fire-safety-critical components.

Lavanya

Lavanya is an accomplished Product Compliance Engineer with over four years of expertise in global environmental and regulatory frameworks, including REACH, RoHS, Proposition 65, POPs, TSCA, PFAS, CMRT, FMD, and IMDS. A graduate in Chemical Engineering from the KLE Institute, she combines strong technical knowledge with practical compliance management skills across diverse and complex product portfolios.

She has extensive experience in product compliance engineering, ensuring that materials, components, and finished goods consistently meet evolving international regulatory requirements. Her expertise spans BOM analysis, material risk assessments, supplier declaration management, and test report validation to guarantee conformity. Lavanya also plays a key role in design-for-compliance initiatives, guiding engineering teams on regulatory considerations early in the product lifecycle to reduce risks and streamline market access.

Her contributions further extend to compliance documentation, certification readiness, and preparation of customer deliverables, ensuring transparency and accuracy for global stakeholders. She is adept at leveraging compliance tools and databases to efficiently track regulatory changes and implement proactive risk mitigation strategies.

Recognized for her attention to detail, regulatory foresight, and collaborative approach, Lavanya contributes significantly to maintaining product compliance, safeguarding brand integrity, and advancing sustainability goals within dynamic, globally integrated manufacturing environments.