Lavanya

Feb 18, 2026

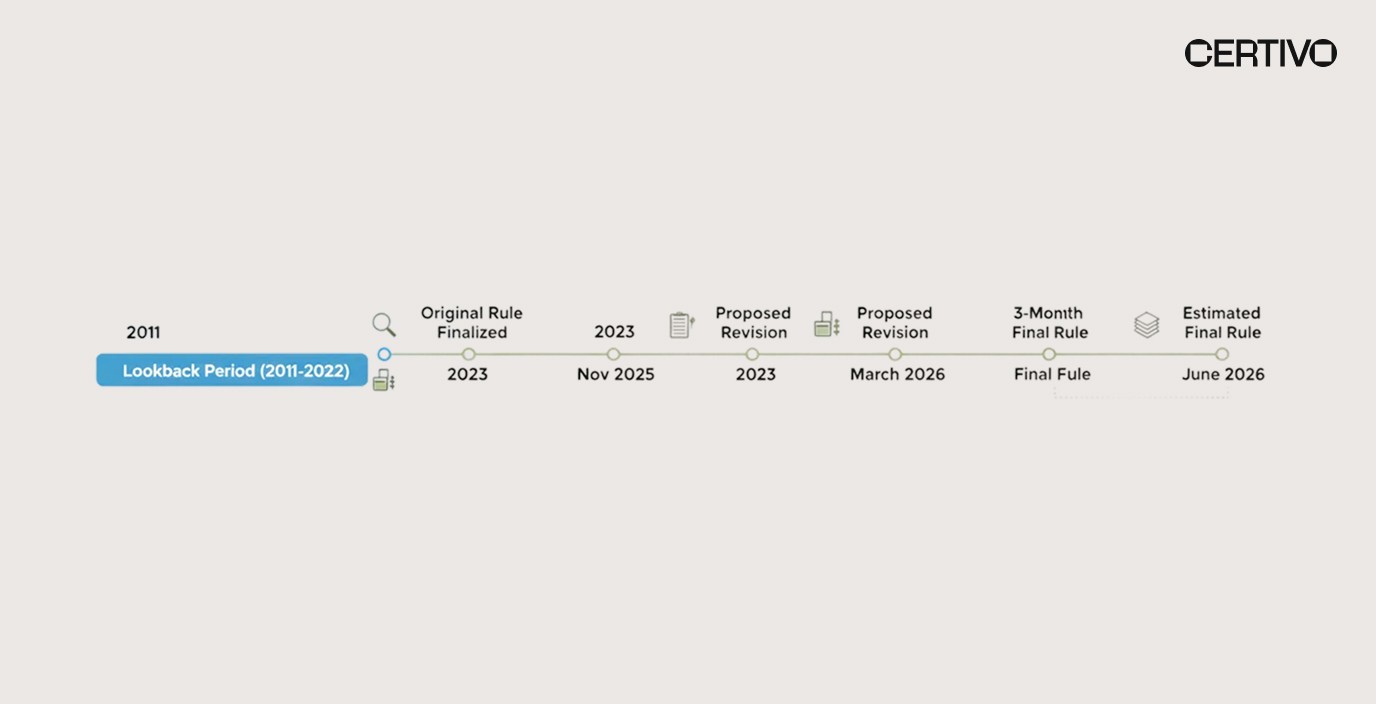

The regulatory landscape for PFAS compliance in the United States is undergoing its most significant shift since the original rule was finalized. In November 2025, the EPA proposed a sweeping overhaul of the TSCA Section 8(a)(7) PFAS Reporting and Recordkeeping Rule — introducing six standard exemptions that could eliminate the TSCA PFAS reporting rule obligations for an estimated 127,000 businesses.

For compliance directors, supply chain leaders, and executive teams at global manufacturing organizations, this proposed revision demands immediate attention. The changes narrow the reporting universe but compress the submission timeline. Understanding whether your organization falls inside or outside the revised scope — and preparing accordingly — is now a board-level compliance priority.

This regulatory update breaks down every material detail from the EPA's proposed revision: who is exempt, who is not, what the new timelines look like, and how manufacturers should prepare for what comes next.

📌 Table of Contents

What Changed: From Universal Obligation to Targeted Reporting

The Six Proposed TSCA PFAS Exemptions Explained

Compressed Submission Timeline: The New Reporting Window

Who Still Has to Report — The "Known or Reasonably Ascertainable" Standard

Industries Affected: Relief, Risk, and Grey Areas

Compliance Risks and Enforcement Under TSCA

Operational and Supply Chain Impact

Compliance Readiness Checklist

The Role of AI in PFAS Compliance Monitoring

Executive Conclusion

FAQs

What Changed: From Universal Obligation to Targeted Reporting

The original 2023 TSCA PFAS reporting rule was unprecedented in its breadth. It required virtually every entity that had ever manufactured, imported, or processed PFAS — or articles containing PFAS — at any point between 2011 and 2022 to submit detailed reports to the EPA. The rule offered almost no exemptions. For a detailed overview of the original federal requirements, see this breakdown of PFAS TSCA Section 8(a)(7) reporting deadlines and obligations.

The result was an enormous reporting universe that swept in retailers, consumer goods companies, automotive importers, and electronics firms alongside primary chemical producers. The compliance burden was massive and, critics argued, indiscriminate. Organizations that had never directly handled PFAS chemicals — but simply imported finished goods — were subject to the same reporting obligations as chemical producers.

⚠ The November 2025 proposed revision fundamentally changes this approach.

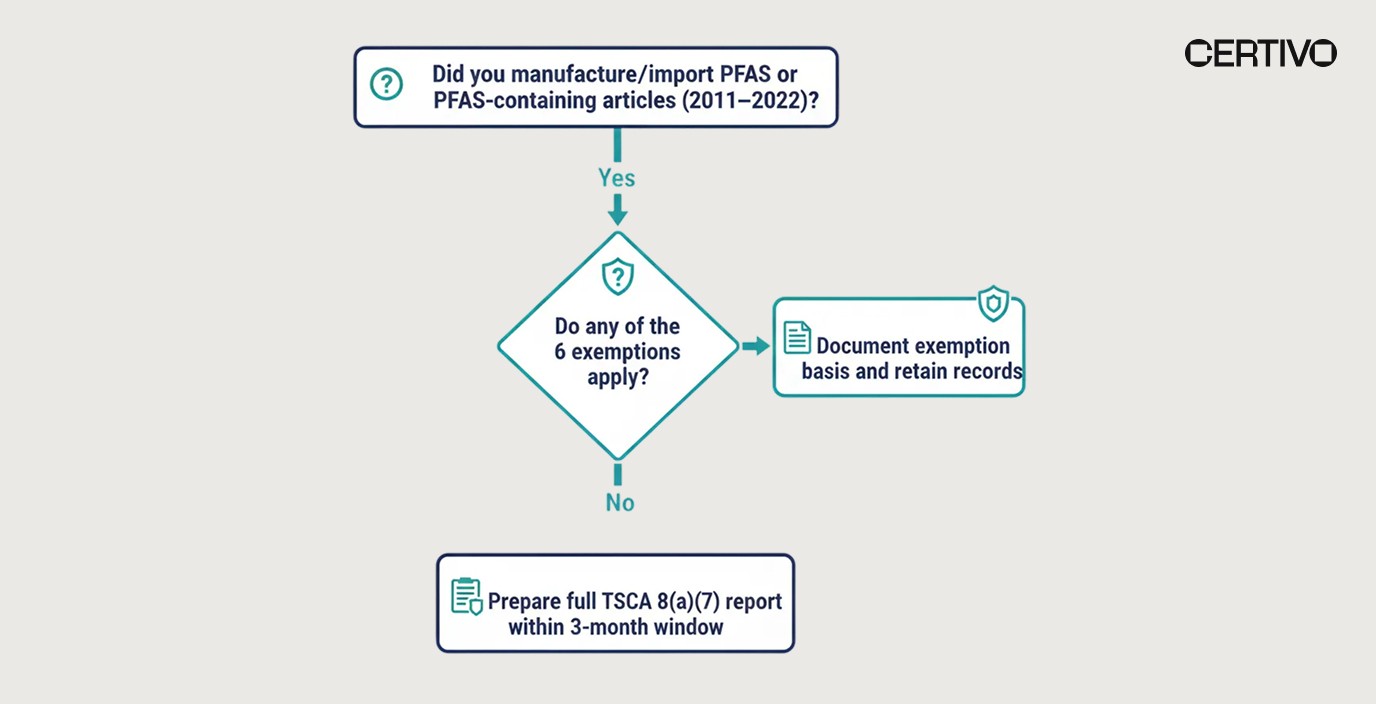

The EPA now proposes applying six standard TSCA exemptions — exemptions that have long existed in other chemical reporting contexts but were deliberately excluded from the original PFAS rule. The stated policy goal: focus the data collection on "primary" manufacturers and importers of PFAS chemicals, the entities most likely to possess detailed chemical identity, production volume, and safety data. Organizations tracking evolving U.S. chemical policy should also review how the current regulatory landscape under the Trump administration affects manufacturer obligations.

📊 Key figure: The EPA estimates these exemptions will remove approximately 127,000 businesses from the reporting universe, narrowing it to roughly 4,000 entities.

This is not deregulation. It is regulatory recalibration. For those 4,000 entities, the obligations remain intensive. And for the 127,000 potentially exempt businesses, confirming exemption status requires documented evidence — not assumptions. Understanding the TSCA framework requirements is critical for tracking where your organization falls under the revised scope.

The Six Proposed TSCA PFAS Exemptions Explained

The core of the EPA's proposed revision is the introduction of six standard TSCA exemptions. If finalized in 2026, businesses falling under these categories will not be required to report. For context on how these exemptions relate to the broader global PFAS regulatory landscape, see the global PFAS regulations master guide for manufacturers.

# | Exemption | What It Covers | Practical Example |

|---|---|---|---|

1 | Imported Articles | Finished products containing PFAS | Laptops, automobiles, textiles imported into the U.S. |

2 | De Minimis Concentrations | PFAS present at ≤0.1% concentration in mixtures or products | Trace-level PFAS in coatings, adhesives, or lubricants |

3 | Byproducts | PFAS produced unintentionally during manufacture of another substance (not used commercially) | Incidental PFAS generated in chemical reactions |

4 | Impurities | PFAS present unintentionally in another chemical substance | Trace PFAS contamination in raw materials |

5 | Research & Development | PFAS manufactured/imported in small quantities solely for R&D | Laboratory-scale PFAS synthesis for testing |

6 | Non-Isolated Intermediates | PFAS produced and consumed within a closed-system manufacturing process | Intermediate PFAS used and consumed in-line |

Each exemption carries specific conditions. The imported articles exemption, for example, applies to finished products — not to bulk chemical imports or raw materials containing PFAS. The de minimis threshold of 0.1% concentration requires manufacturers to have verifiable data on PFAS content in their products and supply chain inputs. Organizations managing thousands of PFAS compounds should understand how AI automates TSCA Section 8(a)(7) compliance at substance level.

✓ Organizations relying on these exemptions must maintain documentation that substantiates their exempt status. The ability to track compliance by BOM — tracing substance presence down to individual components — becomes essential for proving de minimis or imported article exemption eligibility.

⚠ Critical note: Exemption is not automatic. Businesses must evaluate their operations against each exemption criterion and retain records supporting their determination. The ability to stay audit-ready across frameworks is a compliance requirement, not an option.

Compressed Submission Timeline: The New Reporting Window

Beyond the exemptions, the EPA's proposed revision makes a significant change to the submission timeline — one that creates urgency for every entity that remains within the reporting scope. For background on how earlier timeline shifts have affected manufacturer preparedness, see TSCA's PFAS reporting delays and what manufacturers need to do now.

Current baseline timeline:

Submission window: April 13, 2026 – October 13, 2026 (6 months)

Proposed revised timeline:

The submission window opens 60 days after the final rule becomes effective and remains open for only 3 months

Estimated final rule date: June 2026

📊 What this means in practice:

Timeline Element | Current Rule | Proposed Revision |

|---|---|---|

Submission window opens | April 13, 2026 | ~60 days after final rule (est. August 2026) |

Submission window duration | 6 months | 3 months |

Submission window closes | October 13, 2026 | ~3 months after opening (est. November 2026) |

Effective prep time | Several months advance notice | Significantly compressed |

The compressed timeline means manufacturers and importers who remain subject to reporting requirements will have substantially less preparation time. Organizations that have not already begun data collection, substance identification, and reporting system configuration risk missing the window entirely. Teams still relying on manual processes should evaluate replacing spreadsheets with a scalable compliance system before the window opens.

⚠ The lookback period remains unchanged: every year from 2011 to 2022. That is 12 years of manufacturing, importing, and processing data that must be compiled, verified, and reported.

For companies managing complex supply chains across multiple product lines, assembling 12 years of PFAS-related data within a 3-month window is an enormous operational challenge. Understanding what manufacturers need to know about 2026 PFAS rules and compliance readiness is essential for planning resource allocation now.

Who Still Has to Report — The "Known or Reasonably Ascertainable" Standard

For the approximately 4,000 entities that remain within the reporting scope, nothing about the reporting standard has been relaxed. The PFAS compliance framework requirements under TSCA continue to apply in full.

The "known or reasonably ascertainable" (KRA) standard continues to govern what information must be reported. Under KRA, companies must report all PFAS-related information that is:

Already in their possession

Known to company personnel

Reasonably obtainable from existing records, databases, or company systems

Accessible through reasonable inquiry to personnel or suppliers

This standard does not require original testing or new studies. But it does require a thorough, documented search of all existing records and systems. Compliance teams cannot simply claim ignorance — they must demonstrate that a reasonable effort was made to identify all PFAS-related manufacturing and import activity across the full 2011–2022 lookback period. Compliance and regulation managers bear primary responsibility for ensuring this documentation standard is met.

📌 What must be reported (for non-exempt entities):

Chemical identity of each PFAS manufactured or imported

Production and import volumes by year

Categories of use

Byproduct information

Employee exposure data (if known)

Disposal methods (if known)

Effective supplier collaboration and documentation workflows play a critical role here. Much of the required data — particularly for importers — resides with upstream suppliers. Structured data collection from suppliers, validated against known PFAS substance lists, is necessary to meet the KRA standard.

Industries Affected: Relief, Risk, and Grey Areas

The proposed exemptions create a sharply differentiated impact across industries. For organizations assessing how PFAS obligations have evolved across all sectors, see the PFAS compliance in 2026: why "out of scope" no longer exists analysis.

Industry | Impact | Reason |

|---|---|---|

Retailers & Consumer Goods | ✓ Significant relief likely | Article exemption removes obligation for finished goods importers |

Electronics Manufacturers | ✓ Significant burden reduction | Imported article exemption applies to finished components |

Automotive (Importers) | ✓ Significant burden reduction | Finished vehicle and component imports likely exempt |

Chemical Producers | ⚠ Full reporting requirements remain | Primary manufacturers of PFAS substances remain in scope |

Specialty Chemicals & Coatings | ⚠ Partial relief possible | De minimis exemption may apply; depends on concentration data |

Contract Manufacturers | ⚠ Case-by-case evaluation required | Depends on whether PFAS is manufactured vs. present in imported inputs |

For retailers and consumer goods companies, the imported articles exemption represents the most significant change. Companies that import finished products — laptops, textiles, automotive parts, consumer electronics — containing PFAS are likely to fall outside the revised reporting scope entirely. Organizations in the cosmetics sector should also evaluate how this intersects with PFAS and microplastics ingredient bans in the global cosmetics industry.

For chemical producers, the proposed revisions offer little relief. If your organization manufactures PFAS or PFAS-containing chemical substances as a primary commercial activity, full reporting obligations remain. Understanding the complete PFAS framework requirements is essential for ensuring compliance readiness.

For electronics and automotive companies, the key question is whether PFAS exposure is limited to imported finished components or extends to any domestic manufacturing, processing, or chemical handling. Organizations in the automotive sector and semiconductor and PCB manufacturing must map their operations precisely to determine classification status.

Compliance Risks and Enforcement Under TSCA

TSCA violations carry significant penalties. Non-compliance with Section 8(a) reporting requirements — including failure to report, late reporting, or inaccurate submissions — can result in serious consequences. Organizations need to manage compliance risk proactively rather than reactively.

Civil penalties of up to $25,000+ per day per violation (adjusted periodically for inflation)

Criminal penalties for knowing or willful violations

Enforcement actions including compliance orders and injunctions

⚠ Claiming exemption without adequate documentation is itself a compliance risk. If the EPA challenges an organization's exempt status and the organization cannot produce records supporting its determination, it may face penalties for failure to report.

This means the compliance burden does not simply disappear for exempt organizations. It shifts from reporting to documentation. Every business must assess its PFAS exposure, determine its exemption eligibility with documented evidence, and retain those records for potential EPA review. Understanding why people-only compliance approaches cannot scale is particularly relevant when documentation demands exceed manual capacity.

Operational and Supply Chain Impact

The proposed revisions create several operational imperatives for manufacturers and importers. For a broader view of how documentation workloads are increasing across the supply chain, see how tariffs and reshoring are increasing material compliance workloads.

For potentially exempt organizations:

✓ Conduct a thorough PFAS exposure assessment across all product lines and supply chain inputs

✓ Document the basis for each exemption claim (article status, de minimis concentration data, byproduct classification, etc.)

✓ Retain supporting records, including supplier compliance declarations, material safety data, and product composition data

✓ Monitor the rulemaking process — the rule is proposed, not finalized

For organizations remaining in scope:

⚠ Begin or accelerate data collection for the 2011–2022 lookback period immediately

⚠ Identify all PFAS substances manufactured, imported, or processed by chemical identity

⚠ Engage suppliers to obtain PFAS-related data under the KRA standard

⚠ Configure reporting systems compatible with EPA's electronic submission platform

⚠ Allocate compliance resources for a compressed 3-month submission window

Supply chain data gaps represent the most common operational bottleneck. Many manufacturers — particularly those managing global supply chains — lack granular PFAS substance data from upstream suppliers. Streamlining supplier documentation enables structured, auditable data collection from suppliers at scale, aligned with specific regulatory reporting fields.

For organizations managing product portfolios across multiple regions, PFAS compliance under TSCA must also be coordinated with EU REACH PFAS restriction proposals and emerging state-level requirements. Companies operating in multiple U.S. states should track Minnesota's PFAS reporting requirements under Amara's Law and Massachusetts PFAS compliance deadlines alongside federal obligations. The ability to standardize compliance across plants and regions reduces duplication, risk, and cost.

Compliance Readiness Checklist

📌 Use this checklist to assess your organization's preparedness for the revised TSCA PFAS reporting rule:

# | Action Item | Status |

|---|---|---|

1 | Determine whether your organization manufactured, imported, or processed PFAS or PFAS-containing articles between 2011–2022 | ☐ |

2 | Evaluate eligibility under each of the six proposed exemptions | ☐ |

3 | Document the basis for any exemption determination with supporting evidence | ☐ |

4 | If in scope: identify all PFAS substances by chemical identity across the lookback period | ☐ |

5 | Collect production/import volume data by year (2011–2022) | ☐ |

6 | Issue structured supplier data requests for PFAS substance information under the KRA standard | ☐ |

7 | Verify de minimis concentration data (≤0.1%) for any products where this exemption is claimed | ☐ |

8 | Configure electronic reporting systems compatible with EPA's submission platform | ☐ |

9 | Assign internal ownership for TSCA PFAS reporting and exemption documentation | ☐ |

10 | Monitor the Federal Register for final rule publication and effective date confirmation | ☐ |

For organizations still assessing whether their compliance infrastructure is equipped for this kind of regulatory shift, this overview of building a future-ready compliance infrastructure provides a practical framework for evaluation. Procurement and supply chain leaders should be directly involved in items 5, 6, and 7.

The Role of AI in PFAS Compliance Monitoring

The TSCA PFAS reporting rule — even in its revised, narrower form — demands capabilities that exceed what manual compliance processes can reliably deliver. For a detailed look at how AI transforms day-to-day compliance operations, see a compliance engineer's week with and without AI.

The operational demands include:

Substance identification across 12 years of data spanning multiple ERP systems, product lines, and supplier networks

De minimis concentration verification at the product and component level

Exemption classification across thousands of SKUs and import records

Compressed-timeline reporting requiring rapid data aggregation and validation

AI-native compliance platforms address these challenges by:

✓ Scanning BOM and product composition data to identify PFAS presence at the component level

✓ Classifying products against exemption criteria automatically

✓ Aggregating supplier declarations and flagging data gaps

✓ Generating audit-ready documentation that maps directly to EPA reporting fields

✓ Providing regulatory horizon scanning to track rulemaking progress from proposed rule through final publication

For a comprehensive overview of how these capabilities work in practice, see AI tools for compliance management: the complete guide. Organizations specifically evaluating how AI handles PFAS-scale substance management should also review how AI automates compliance across 12,000+ PFAS compounds.

For organizations managing PFAS compliance alongside EU REACH obligations and emerging state-level rules, AI in supply chain compliance management consolidates regulatory data across jurisdictions. IT and systems leaders play a critical role in evaluating and deploying these platforms.

Executive Conclusion

The EPA's proposed revision to the TSCA PFAS reporting rule represents a significant recalibration of federal PFAS compliance obligations. The introduction of six standard exemptions — particularly for imported articles and de minimis concentrations — will provide meaningful relief for tens of thousands of businesses. But for the approximately 4,000 entities that remain in scope, the requirements are unchanged and the timeline is compressed.

Whether your organization is likely exempt or still subject to full reporting under the revised TSCA PFAS reporting rule, the compliance imperative is the same: assess your PFAS exposure, document your determination, and prepare your data now. The compressed 3-month submission window and the 12-year lookback period leave no margin for delay. For a broader perspective on upcoming PFAS deadlines across federal and state levels, review the 2025–2026 PFAS compliance countdown for manufacturers.

📌 The official EPA proposed revision is available on the Federal Register.

Organizations managing complex product portfolios, global supply chains, and multi-jurisdictional PFAS obligations need compliance infrastructure that can scale with regulatory complexity. To explore how AI-driven compliance platforms like Certivo support continuous regulatory readiness, connect with the Certivo team.

Frequently Asked Questions

Q1: Does the proposed revision eliminate TSCA PFAS reporting entirely?

No. The proposed revision introduces six exemptions that narrow the reporting scope from approximately 131,000 businesses to roughly 4,000 entities. Primary manufacturers and importers of PFAS chemicals remain fully subject to reporting. Organizations must evaluate their specific operations against each exemption to determine eligibility. For a full overview of federal PFAS requirements, see the TSCA framework page.

Q2: What is the de minimis concentration threshold under the proposed revision?

The proposed de minimis threshold is 0.1% (1,000 ppm). PFAS present at or below this concentration in mixtures or products would be exempt from reporting if the revision is finalized. Organizations claiming this exemption must have verifiable concentration data. The ability to track compliance at the BOM level enables substance tracking at the granularity required to substantiate de minimis claims.

Q3: Has the lookback period changed?

No. The lookback period remains 2011 to 2022 — every year. Organizations that are subject to reporting must compile and submit data covering this entire 12-year period. For background on the original timeline and previous delays, see PFAS reporting requirements: are you ready for April 2026.

Q4: When is the final rule expected, and what is the new submission window?

The EPA estimates the final rule will be published around June 2026. Under the proposed revision, the submission window would open 60 days after the effective date and remain open for only 3 months — significantly shorter than the current 6-month window. Organizations should monitor the EPA Proposed Revision on the Federal Register for official publication updates.

Q5: If my company only imports finished products containing PFAS, do I still need to report?

Under the proposed revision, the imported articles exemption would eliminate the reporting obligation for businesses that only import finished products (such as electronics, vehicles, or textiles) containing PFAS. However, this exemption is not yet finalized. Organizations should document their article import status and monitor rulemaking developments. Companies in the industrial electronics sector and automotive industry are among those most likely to benefit from this exemption.

Lavanya

Lavanya is an accomplished Product Compliance Engineer with over four years of expertise in global environmental and regulatory frameworks, including REACH, RoHS, Proposition 65, POPs, TSCA, PFAS, CMRT, FMD, and IMDS. A graduate in Chemical Engineering from the KLE Institute, she combines strong technical knowledge with practical compliance management skills across diverse and complex product portfolios.

She has extensive experience in product compliance engineering, ensuring that materials, components, and finished goods consistently meet evolving international regulatory requirements. Her expertise spans BOM analysis, material risk assessments, supplier declaration management, and test report validation to guarantee conformity. Lavanya also plays a key role in design-for-compliance initiatives, guiding engineering teams on regulatory considerations early in the product lifecycle to reduce risks and streamline market access.

Her contributions further extend to compliance documentation, certification readiness, and preparation of customer deliverables, ensuring transparency and accuracy for global stakeholders. She is adept at leveraging compliance tools and databases to efficiently track regulatory changes and implement proactive risk mitigation strategies.

Recognized for her attention to detail, regulatory foresight, and collaborative approach, Lavanya contributes significantly to maintaining product compliance, safeguarding brand integrity, and advancing sustainability goals within dynamic, globally integrated manufacturing environments.